The 10 largest Manhattan real estate loans recorded in November totaled $1.8 billion — just shy of the $2.1 billion recorded in October and last November’s top ten loans.

Vornado Realty Trust and the Trump Organization’s $950 million refinance of 1290 Sixth Avenue topped the list. Condo inventory and retail loans in the Financial District and Midtown, respectively, were next, for much lesser amounts. Tishman Speyer secured another $100 million in loans for its Spiral building in Hudson Yards, which came out to relative pocket change in comparison to the project’s $3.7 billion cost.

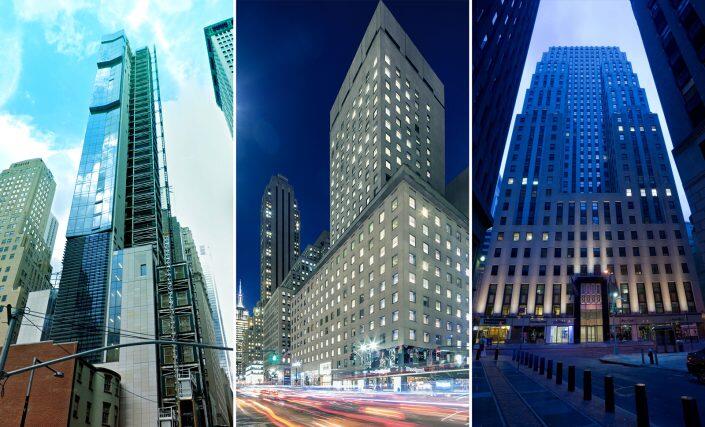

77 Greenwich Street, 530 Fifth Avenue and 80 Broad Street (Google Maps, Avison Young, Swig Equities)

Here were Manhattan’s largest real estate loans in November:

1. Quad squad | $950 million

A big loan needs big lenders. Vornado Realty Trust and the Trump Organization received a $950 million loan from JPMorgan, Citibank, Goldman Sachs and Bank of Montreal to refinance existing debt at 1290 Sixth Avenue, a 2.1 million-square-foot office tower in Midtown. The lenders will securitize the debt and sell it to investors as bonds backed by the building’s mortgage. Vornado owns 70 percent of the tower, which is 98 percent occupied by 25 tenants, with subleases accounting for a quarter of the filled space.

2. Trophy debt | $128 million

Trinity Place Holdings received a $128 million condo inventory loan from Australian investment bank Macquarie Group for 77 Greenwich Street, a new 90-unit trophy condo project in the Financial District that has faced cost overruns and sluggish sales. The total debt package is worth $167 million with mezzanine lender Davidson Kempner extending an additional $22.8 million. Ryan Serhant took over marketing at the building in April.

3. Retail reset | $125 million

Signature Bank provided Aurora Capital Associates and hedge funder Edmond Safra with $125 million to buy a block-long retail condo at 530 Fifth Avenue in Midtown. The Aurora-Safra partnership paid $192 million for the property, roughly a third less than the $295 million that Brookfield Property Partners paid near the height of the market in 2014. Asking rents for retail on Fifth Avenue between 42nd and 49th streets have declined 55 percent since their height in 2016.

4. Refi, rinse, repeat | $113 million

PCCP provided Invesco Real Estate with a $112.5 million loan — part of $150 million in overall funds — to refinance its 432,000-square-foot office building at 80 Broad Street in the Financial District. Invesco received a $102 million mortgage on the property in 2017 from AIG Investments, about a month after Invesco purchased a 95 percent stake in the building from Broad Street Development for $235 million. Broad Street, which manages the property, bought it in 2014 for $175 million and retains a 5 percent stake.

5. All in | $105 million

Korean firm Daishin F&I loaned $105 million to its parent company Daishin Securities as owner of 400 Madison Avenue in Midtown. The proceeds replace a $100 million acquisition loan made by South Dakota-based Midland National Life Insurance Company in 2018, when Daishin paid $195 million to ASB Capital Management for the building. ASB had acquired the property from William Macklowe in 2012.

6. Spiraling | $100 million

KKR provided Tishman Speyer with a $100 million mortgage loan for its Spiral tower, a 2.6 million-square-foot office building at 66 Hudson Boulevard in Hudson Yards. The loan represents 2.7 percent of the building’s overall cost — a staggering $3.7 billion. The building — now 54 percent leased — counts tenants including Pfizer, AllianceBernstein, Debevoise & Plimpton and Turner Construction, which led building the tower as general contractor.

Read more

7. London calling | $82 million

Bank of America loaned $82 million to London Terrace Towers, two luxury co-op buildings bound by 9th and 10th Avenues between 23rd and 24th Streets in Chelsea with a roster of celebrity owners. The loan includes $36.6 million in new debt and consolidates existing mortgages at the property. Sports stars including Milos Raonic and Tom Brady have reportedly laid their heads at the luxe pads.

8. Company store | $73 million

SL Green extended $73 million in seller financing to the Hematian family, owners of the Effy Jewelry company, for its $103 million purchase of 590 Fifth Avenue. The office REIT gained control of the building’s equity interest in 2020 following a foreclosure action against Joe Sitt’s Thor Equities after the developer had defaulted on a $25 million mezzanine loan. SL Green took over the building’s $83 million senior mortgage originated by Wells Fargo as part of the foreclosure.

9. High Line loan | $60 million

The mortgage-lending arm of John Hancock Life Insurance extended $60 million to the owners of 539 West 28th Street, a 405-unit rental building in West Chelsea developed by Avalon Bay. Invesco purchased an 80 percent stake in a portfolio in 2018 that included the building, with Avalon Bay retaining 20 percent ownership. Investment management firm Eight Points Asset Management signed for the loan through limited liability company East Side 11th & 28th.

10. Pay dirt | $54 million

Acore Capital loaned $54 million to heirs of late real estate investor Milton Kimmelman and the Leigh family who are the fee owners of 555 Fifth Avenue, a 257,000-square-foot office building in Midtown’s Plaza District. ATCO Properties holds the building’s ground lease. The Kimmelmans acquired a 50 percent interest in the ground underneath the building in October valued at $50 million.