With his reflective sunglasses, sharp suit and phosphorescent teeth, Eric Adams fit right in at Summit One Vanderbilt, the mirrored observation deck atop SL Green’s new trophy tower near Grand Central. It was October 2021, and New York’s next mayor was ringing in a tourist trap at the city’s priciest office building, even though both tourism and office occupancy remained abysmal.

As Adams and other figureheads predicted a bright future for the edifice, and by extension the city, they hit upon a key truth those in commercial real estate have long known: The city’s economy depends largely on its office sector. When New York’s offices emptied in April 2020, so did Manhattan streets. Now, as the city creeps cautiously back to its old self, the office market is showing signs of recovery too.

With data from CompStak, The Real Deal ranked the 10 biggest Manhattan office leases signed in 2021 by the amount of money scheduled to be paid over their lifetimes.

The 10 leases totaled $3.8 billion, a 20 percent increase from last year but still less than half of 2019’s total of $7.85 billion. The top deals were scattered across the island, from the standard office corridors of Madison Avenue and the Financial District to hip outposts on the Lower East Side and Chelsea.

For the second year in a row, Vornado’s Penn Plaza development pulled in the top deal. New construction and total renovations reigned in a “flight to quality,” as employers envision that getting their people back to the office will require a top-notch working environment.

1. MSG Entertainment | 2 Penn Plaza | Low $100s psf | $951 million

2 Penn Plaza

This list-topping deal keeps the entertainment company behind MSG and Radio City Music Hall at Vornado’s 2 Penn Plaza, with $951 million to be paid out over 20 years. MSG Entertainment, led by New York sports antihero James Dolan, took 428,000 square feet as Vornado plans sweeping renovations to the 31-story tower. When the redevelopment is complete, the building will span 1.8 million square feet, giving MSG roughly a quarter of the space. The agreement is well short of last year’s biggest deal, in which Facebook dropped $1.18 billion at another Vornado space in Penn Plaza.

2. Chubb | 550 Madison Avenue | Low $90s/Low $160s psf | $566 million

550 Madison Avenue

In November, global insurance firm Chubb picked up 240,000 square feet across 10 floors in Olayan Group’s 550 Madison Avenue. (RXR Realty provides development services at the building.) It will spend $566 million across the life of the deal. Chubb is making the jump up to one of the most expensive stretches of Madison Avenue from Durst Organization’s 1133 Sixth Avenue near Bryant Park. Historically, 550 Madison leased only to AT&T and Sony. Chubb is the first tenant to sign on since luxe renovations doubled its public open space, added a private library and spruced up the lobby.

3. Fried Frank | 1 New York Plaza | Financial District | High $50s psf | $508 million

1 New York Plaza

Legal powerhouse Fried Frank renewed its lease for 400,000 square feet at One New York Plaza, the New York Post reported in July. At $508 million for more than 10 years, the lease was the largest in the Financial District and came at a time of massive vacancies in the Lower Manhattan commercial sector. Yet it also represented the lowest rate per square foot on this list. The 50-story tower is owned by Brookfield and stands at the southern tip of the island.

4. Icahn School of Medicine at Mount Sinai | 787 11th Avenue | Columbus Circle | Low $80s psf | $429 million

787 11th Avenue

With this $429 million, 165,000-square-foot deal, Mount Sinai’s Icahn School of Medicine is poised to play a big role in the West Side’s transition into a life sciences hub. This March, the medical school inked the long-term lease at Georgetown Company and Bill Ackman’s 787 Eleventh Avenue near Columbus Circle. Mount Sinai will share the building with Ackman’s Pershing Square Capital. This was the only first-quarter deal to make the list.

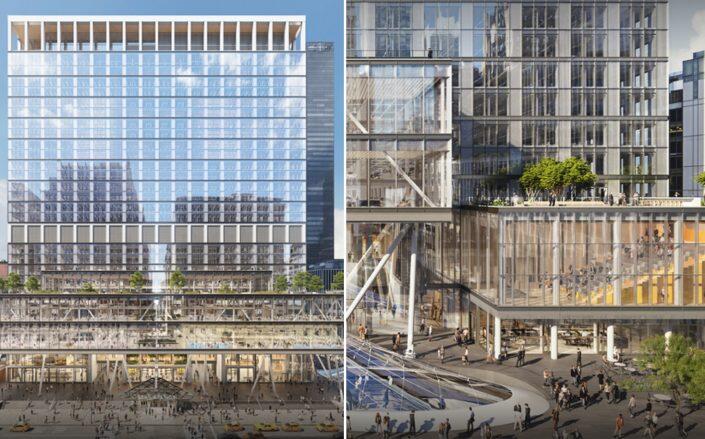

5. Stoneridge Asset Management | 1 Vanderbilt Avenue | Grand Central | Low $220s psf | $311 million

1 Vanderbilt Avenue

In August, Stoneridge sprung for the smallest space and the highest price per square foot of any deal on this list. The finance firm committed to pay $311 million for 100,000 square feet at SL Green’s One Vanderbilt, with rents rising to $245 psf over the course of the 15-year deal. That’s around three times the average Midtown rent. One Vanderbilt is the poster child for the lavish office towers that are leading the flight to quality. The Real Deal reported SL Green was asking as high as $322 psf for top-floor offices at the tower, which borders Grand Central Terminal.

6. Venable LLP | 151 West 42nd Street | Times Square | Low $100s psf | $232 million

151 West 42nd Street

The Durst Organization roped yet another cash cow at One Five One (formerly Four Times Square). Venable, a law firm based in Washington, D.C., signed a 15-year, $232 million lease in October. The firm will occupy 158,000 square feet at the tower, which made this list last year when TikTok booked seven floors for $237 million. The Venable deal highlighted a third-quarter rebound for the Midtown South office market.

7. Verizon | 155 Delancey Street | Lower East Side | Low $80s psf | $230 million

155 Delancey Street

The telecom giant set the groundwork for a massive corporate campus in downtown Manhattan, signing for 140,000 square feet at the Essex Crossing development on the Lower East Side. The deal gives Verizon the option to expand its footprint at the Delancey Street site to 350,000 square feet across two buildings. Essex Crossing is being developed by a handful of firms including Taconic Partners, L+M Development Partners, The Prusik Group, BFC Partners and Goldman Sachs’ Urban Investment Group. Verizon still has offices in Tribeca, Midtown and Fort Greene.

8. BDO | 200 Park Avenue | Mid $70s/Low $90s | $202 million

200 Park Avenue (Getty)

Chicago-based accounting firm BDO signed a 15-year lease for 145,000 square feet in the MetLife Building at 200 Park Avenue. Employees won’t move in until January 2024, but when they do, they’ll be coming from three different offices on Park and Third Avenues. The building, co-owned by Tishman Speyer and the Irvine Company, also houses CBRE.

Read more

9. Dechert | 1095 Sixth Avenue | Midtown | High $90s | $198 million

1095 Sixth Avenue (Google Maps)

It was a big December for Dechert as the law firm renewed its lease at 1095 Sixth Avenue in Midtown. The deal — $198 million for 241,000 square feet — came at the end of Dechert’s 20-year lease at the tower. Ivanhoe Cambridge bought the building, which features a Whole Foods and luxury watchmaker Bucherer, from Blackstone in 2015 for $2.2 billion.

10. CLEAR | 85 10th Avenue | Chelsea | Low $100s | $182 million

85 10th Avenue

CLEAR, the biometric security company whose fast-pass kiosks dot TSA lines, rounds out this year’s list with its $182 million lease at 85 10th Avenue. In November, the company secured 120,000 square feet for 15 years at Vornado and Related’s Chelsea building. CLEAR also nabbed 16 months of free rent and a monthly abatement of more than $83,000 through 2027.