From his perch in Hasidic South Williamsburg, Yoel Goldman and his company, All Year Holdings, amassed a Brooklyn real estate empire worth over $1 billion.

He is now on the verge of losing it.

His company missed payments to bondholders while Goldman faced fraud allegations and disputes with investors. He was forced to cede decision-making power last year to restructuring officers. Most recently, All Year Holdings filed for Chapter 11 bankruptcy.

The company also sold the crown jewel of its portfolio — the 911-unit Denizen rental complex in Bushwick — for $506 million to Atlas Capital Group after putting the project into bankruptcy to stop a foreclosure by its mezzanine lender, Mack Real Estate Group.

But Goldman, the lone shareholder of All Year Holdings, is not giving up easily.

Goldman, his management company All Year Management and the Denizen’s general contractor APT Development are allegedly refusing to turn over copies of the Denizen’s books to Mack Real Estate and a court-appointed bankruptcy administrator, Tracy Klestadt.

The allegations were included in a motion filed by Klestadt as part of bankruptcy proceedings tied to the Denizen in New York’s Southern District. The administrator said the records are needed to resolve claims relating to the Denizen, most of which are related to construction work.

The filing shows the difficulties that creditors, lenders and even All Year Holdings have faced in their dealings with Goldman. It also suggests that Goldman still has pull with his former company despite an agreement to give that up.

Klestadt alleges All Year Holdings and the restructuring officers have access to the books and records of a company tied to the Denizen, but that Goldman has told them not to turn them over.

The restructuring officers “expressed hesitancy” to hand over this information “out of fear that Mr. Goldman will assert some sort of cause of action against them if they do,” according to the filing.

All Year Holdings filed a response on Thursday stating that it has worked to turn over all records it had in its possession.

It added that it has spent “many hours attempting to persuade Mr. Goldman and the principal of APT Development, Mr. Yoel Schwimmer, to transfer all of the books and records to the plan administrator.” It claims that it has access to some additional documents, but not the legal possession and is concerned about the liability of releasing them.

A “complete disaster”

Obtaining these records has proven to be a major headache ever since a bankruptcy plan was approved Nov. 5, emails show.

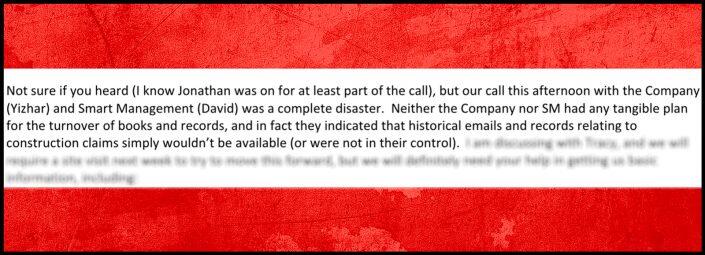

On Dec. 1, Mack Real Estate’s attorney, Kizzy Jarashow of the law firm Goodwin Procter, emailed All Year’s attorneys about a call attended by All Year Holdings Chief Financial Officer Yizhar Shimoni along with David Friedman of Smart Management, the property manager of the Denizen.

“Our call this afternoon with the Company (Yizhar) and Smart Management (David) was a complete disaster,” the email read. “Neither the Company nor SM had any tangible plan for the turnover of books and records.”

About a week later Jarashow said in an email that a group that included Goodwin Procter attorneys and the bankruptcy plan administrators went into All Year’s office in Williamsburg, Brooklyn.

But the trip proved futile. Upon arrival, they were told by All Year representatives that Goldman or the general contractor control the records and nothing can be done without their consent, according to the email.

All Year purchased the two sites that make up the Denizen complex — 54 Noll Street and 123 Melrose Street — in 2015 and 2016 for $68.5 million and $72.2 million, respectively.

Built on the former Rheingold Brewery, the Denizen is known for attracting millennial tech employees. In February, the Denizen’s corporate entities declared Chapter 11 bankruptcy.

All Year representatives did not respond to requests to comment, nor did Goldman or APT Development’s Schwimmer. Klestadt and Jarashow also did not answer a request to comment.