Remote workers hefting six-figure salaries from big cities to small towns across the West have led to skyrocketing home prices — and fewer affordable homes for locals.

The housing crisis in the remote Methow Valley in north central Washington state was so severe that civic leaders came up with a novel solution, the Seattle Times reported. They launched a community land trust to help middle-class residents afford a home.

Like many other Western mountain towns such as Jackson Hole, Wyoming, and Sun Valley, Idaho, a string of small towns along the Methow River faced a daunting shortage of affordable homes because of growing gentrification.

Second homeowners and remote workers relocating from larger metropolitan areas like Seattle had driven up median home prices from $270,000 in 2016 to $500,000, with no end in sight.

Small business owners and employees were left scrambling to find affordable digs.

Read more

Twenty-seven-year-old Molly Starcher, who had opened a bakery in the town of Winthrop, struggled for years to find a decent home. She house sat, lived out of her car, even turned a shed into a tiny house with no running water. Finally she landed a small one-bedroom apartment for $900 a month, the newspaper reported.

Jonathan Baker runs eqpd, a small manufacturer of reusable bags that provides year-round jobs paying $17 to $20 per hour. The company has seen sales double in the past two years, but can’t find the labor to grow the business. Wage workers cannot afford housing nearby.

“I could buy an extra sewing machine but I don’t have the person to put behind it,” Baker told the Times. “I’ve narrowed down the problem. It isn’t the pay. The housing doesn’t exist or it’s only available for three months. We need something other than single-family homes. We need apartments.”

For some, the answer may lie in the Methow Housing Trust, a community land trust formed in 2017 in the wake of a wildfire that torched 350 homes.

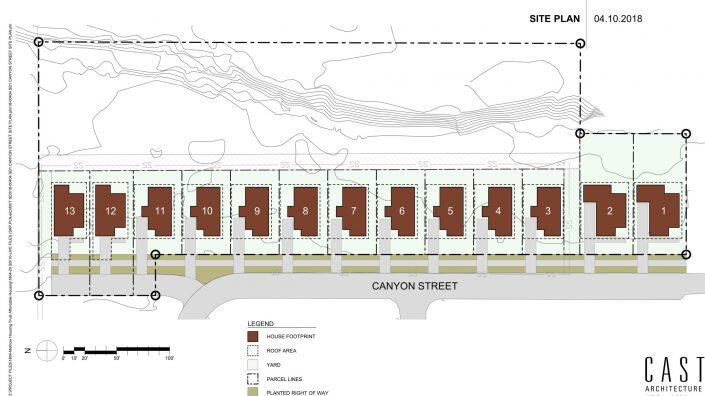

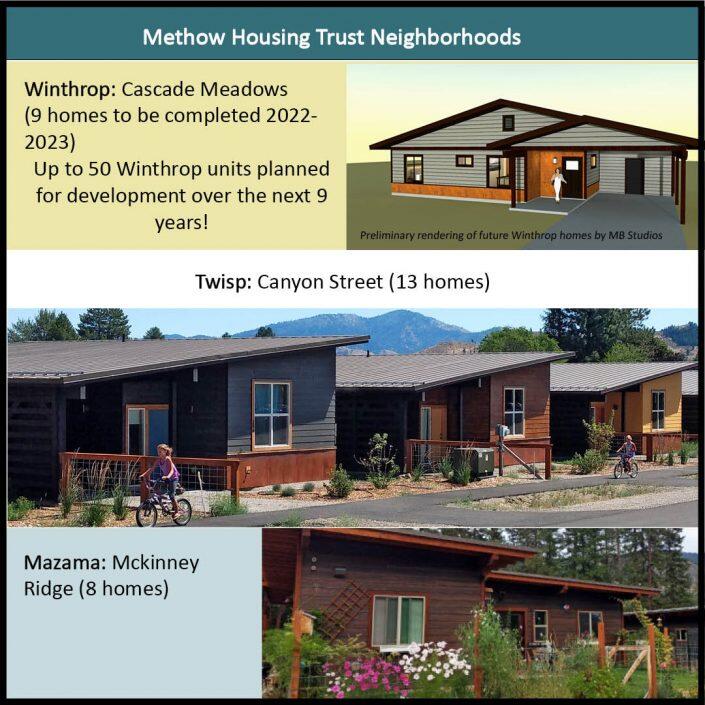

The trust has built 21 homes in the Methow Valley, with two 8-acre parcels currently under development. Its goal is to build 70 new homes by the end of the decade. The waitlist for a trust home has doubled every year and now stands at 40 families.

The catch? Buyers don’t own the land underneath — the trust does.

Each buyer is guaranteed 1.5 percent annual appreciation, well below the double-digit year-over-year price growth on the open market. In exchange, each house will be kept affordable for future buyers.

Thirty-four-year-old Chris Moore, a cross-country ski instructor, and his partner Keri earn in the high $50,000s, about 120 percent of area median income. They were able to buy a trust home for $160,000.

(Courtesy of the Methow Housing Trust)

“We want to maintain an integrated community,” said Danica Ready, executive director of the Methow Housing Trust. “If you work here, you should be able to live here. We don’t want to bus people in like in Jackson Hole.”

[ST] — Dana Bartholomew