If a 421a building owner overcharges tenants and no agency is there to see it, is anyone held accountable?

For Aaron Carr, founder of the tenant advocacy group Housing Rights Initiative, unchecked fraud is a key issue with the tax break that the governor must address if she reboots the program.

The 421a program, aka Affordable New York, is set to expire June 15 and Gov. Kathy Hochul has outlined a replacement called 485W or Affordable Neighborhoods for New Yorkers.

Tenant advocates panned Hochul’s proposal for perpetuating the problems they see in 421a, namely big property tax breaks for projects whose “affordable” units are well beyond the means of many New Yorkers.

421a requires affordable units for those making 130 percent of the area median income; the proposed sequel would drop that threshold to those making between 40-90 percent of the area median income. The modification still excludes the largest chunk of city renters by income — the more than a quarter who fall into the extremely-low income bracket, according to the Association for Neighborhood & Housing Development.

“I just don’t know how you could call it an affordable housing program,” Lander said during an NYU Furman Center panel talk. “It’s an indefensible program.”

HRI, like many tenant groups, is against any reincarnation of 421a.

“Gov. Hochul and the New York state legislature should heed the call of Comptroller Brad Lander to reform our property tax system and kick the 421a program into the Hudson River,” Carr said.

But with the governor aiming to reform the program, Carr said she should include a plan to ensure owner compliance so tenants aren’t overcharged.

HRI said it has uncovered a plethora of owners who violate the rule requiring percentage of units to be rent-stabilized while receiving the tax break. The group said it has identified 1,500 421a buildings that have cheated, opened nearly a dozen investigations into questionable practices and launched several class-action suits.

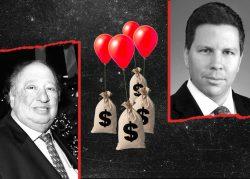

HRI’s most recent complaint, which it planned to file yesterday, exemplifies a scheme it sees often. The suit alleges owner Adam America Real Estate overcharged at least 100 rent-stabilized tenants while reaping the tax benefits of 421a.

The case, filed on behalf of tenants at 595 Baltic Street, a Boerum Hill building developed by Adam America, claims the owner “hoodwinked” the building’s tenants and the state’s Division of Homes and Community Renewal by registering rents with HCR that did not reflect concessions, such as rent-free months.

Read more

Preferential rents — which are lower than the regulated, or “legal” rent an owner can collect — are forbidden in 421a buildings. But owners use them to lure tenants, then raise the rent to the legal rate at renewal, the suit claims.

For example, the Baltic Street owner registered apartment 4D’s rent at $6,000, then charged tenants less than $4,000 a month, on average, in the first year. The annual increases approved by the Rent Guidelines Board were then applied to the $6,000 registered rent, the complaint alleges.

Before the rent law was overhauled in 2019, the scheme could be used to take units out of rent stabilization entirely.

“It’s essentially treating a rent-stabilized unit as a free-market unit,” said Roger Sachar, a partner at Newman Ferrara and one of the attorneys for the plaintiffs.

Sachar said Adam America saved $1.5 million in taxes on the Baltic Street property over the past two years alone. The landlord did not respond to a request for comment.

“These guys wanted to have their cake and eat it too,” said Lucas Ferrara, founder of Newman Ferrara, who is also representing the plaintiffs.

However, at least one lawsuit challenging the concession scheme was tossed out by a judge. In that case, John Catsimatidis’ company was the developer, and the landlord lobby celebrated the win. Newman Ferrara’s lawyers said the ruling was based on a technicality, not the merits of their case, and was wrong in any event.

The attorneys said what HRI uncovered speaks to a “long line of cases” alleging abuse of the 421a program, and that penalties for noncompliance are scant.

If a court finds a 421a owner overcharged tenants, that landlord has to repay the excess and reset the rent, Sachar said. But the owners keep their tax benefits and don’t face criminal charges.

Hochul’s proposed 421a replacement would increase penalties on offending landlords, strip them of the tax benefit and keep units rent-stabilized for the tax break’s original term.

But she did not otherwise outline how the state would ensure owners comply.

“It’s fair to say for too long this went on the honor system with no independent audit by any state or city agency,” Ferrara said. “As long as the apartments were registered with HCR and no one complained, nothing happened.”

The governor’s office did not respond to a request for comment on whether it would enforce compliance. However, any 421 replacement must be approved by the legislature, which will almost certainly demand changes to Hochul’s proposal.

The governor’s reform has already garnered the support of the Real Estate Board of New York, a powerful landlord lobby, whose chair Douglas Durst donated $55,000 to Hochul’s election campaign.

And while tenants won major reforms to rent regulation in 2019, their recent attempts to affect policy have fallen flat: Hochul proposed to tweak 421a rather than let it die, let the eviction moratorium lapse and has yet to support good cause eviction, which is stalled in the Senate Judiciary Committee.

The governor has committed to creating or preserving 100,000 affordable homes in the next five years; 421a’s successor could help Hochul meet that goal. But if added oversight and penalties deter developers from taking part in the program, it could keep Hochul from reaching her housing goals.

Still, Sachar said without enforcement protocols, there’s nothing to deter owners from trying to skirt the rent-stabilization mandates under a new version of 421a.

“For landlords, it’s a good gamble, because if they get caught all they’ve got to do is refund the money, ” said Sachar. “They have nothing to lose.”

Correction: This article has been updated to reflect the AMI requirements proposed for 485W.