Proptech-focused venture capital firm Fifth Wall has bailed on plans to raise $150 million by taking a second real estate tech firm public through a special purpose acquisition company, or SPAC.

The Marina del Ray-based firm withdrew its SEC registration for Fifth Wall Acquisition Corp. II, according to a filing submitted Friday and first reported by dot.LA.

Fifth Wall revealed plans for a second SPAC last March, intending to list the blank-check company on the Nasdaq exchange under the ticker FWAB and issue 15 million shares at $10 apiece. It recruited Wall Street banks Goldman Sachs, Citi and Deutsche Bank as joint underwriters on the deal, according to IPO research firm Renaissance Capital.

The withdrawal comes as the once-hot market for proptech SPACs has generally fizzled after a string of public debuts during the pandemic. Meanwhile, the broader stock market continues to teeter on correction territory, with stocks see-sawed by Russia’s invasion of Ukraine.

With its first SPAC, Fifth Wall took Arizona-based home automation company SmartRent public last August, in a deal that raised $450 million for the startup. SmartRent’s stock then rose north of $14 per share in early September, but has since shed more than half of its value and closed trading Monday at $6.45 per share — mirroring the wider downturn in the SPAC market.

Fifth Wall launched a third SPAC last April, which raised $275 million in its Nasdaq debut a month later. That blank-check entity currently trades under the ticker FWAC but has yet to merge with another company, a la SmartRent.

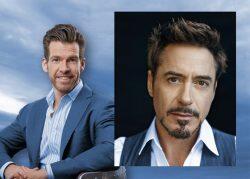

Fifth Wall is led by co-founder Brendan Wallace, who has served as its managing partner since 2016, and CFO and Director Andriy Mykhaylovskyy, who has been managing partner since 2017. Wallace is an investor in dot.LA.

The venture capital firm did not respond to requests for comment from the publication as to why it killed its second SPAC.

In June, Fifth Wall and actor Robert Downey Jr. invested in a firm that offers financing incentives for homeowners who want to reduce their energy consumption.

The company, Sealed, scored $16 million in Series B funding, led by Fifth Wall. Investors include Downey’s newly-created FootPrint Coalition Ventures, Cyrus Capital and CityRock Ventures.

The venture firm is also raising funds for a late-stage climate tech fund, according to another SEC filing last week. Fifth Wall did not disclose how much it intends to raise for the new fund. It has secured at least $140 million for a similar fund focused on early-stage climate tech startups, dot.LA reported last year.

Earlier this month, Fifth Wall announced that it had raised roughly $159 million for its first European fund.

[Dot.LA] – Dana Bartholomew

Read more