Rockrose Development refinanced a luxury apartment building in the nick of time, dodging the specter of rising interest rates.

Rockrose refinanced its multifamily asset at 47-05 Center Boulevard in Long Island City for $210 million, the Commercial Observer reported. MetLife provided the 15-year, fixed-rate loan on the property.

The 31-story luxury building was constructed in 2007. The building includes 396 units and amenities like an indoor swimming pool, a spa with a steam room, a sauna and massage rooms.

An Avison Young team led by Andy Singer and Kathleen McSharry arranged the refinancing, which had its interest rates locked in December, according to the Observer. Rockrose COO Richard Brancato told the publication that the transaction was the first one the developer closed with MetLife.

Other recent financings by Rockrose include a $240 million loan from Morgan Stanley at the Linc rental building in 2014 and permanent financing for the Eagle Lofts project at 43-22 Queens Street in 2020, according to the Observer.

Read more

The developer unveiled plans for another residential building in Long Island City at the end of 2020, filing for a 19-story building in the neighborhood. The building is set to have more than 300 apartments, along with about 4,000 square feet of retail space on the ground floor.

Earlier this year, Rockrose purchased the remaining stake in 11 East 26th Street in a deal valued at $145 million. The firm previously held a nearly 50 percent stake in the office building after acquiring a 14 percent interest months earlier, then another 5 percent in November. The developer plans to reposition the 21-story, 260,000-square-foot building, as well as one it owns next door.

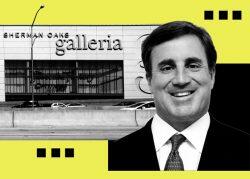

As for MetLife, the company recently provided a $300 million mortgage loan to Douglas Emmett for its Sherman Oaks Galleria as nearly half of the office space available at the complex is vacant. The financing replaces a $500 million loan provided by MetLife in 2016, records show.

[CO] — Holden Walter-Warner