It’s been a grim couple of months for New York City’s office market.

Occupancy rates have been slow to recover as most white-collar workers continue to stay home. Blackstone, one of the city’s largest commercial landlords, handed back the keys to a Midtown office tower last month after its loan went into special servicing. And for the first time in over two decades, the total market value of the city’s office buildings declined, according to the state’s comptroller, tumbling 16.6 percent in fiscal year 2022.

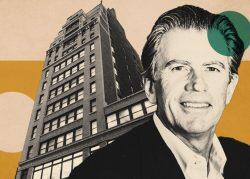

But commercial broker Michael Rudder believes that a niche asset class can be a hedge against distress in the broader market. Unlike a traditional office lease that is subject to rent hikes, office condos allow tenants to buy properties outright, much like a residential condo.

Rudder might be onto something: In the second half of 2021, office condo sales totaled $179.2 million, up 27 percent from the five-year average, according to data from Rudder’s firm, Rudder Property Group.

Still, the sector is tiny. Consisting of 103 buildings and 11.2 million square feet, it makes up less than 2 percent of Manhattan’s office market. Nonetheless, Rudder said that more landlords are asking about converting their existing vacancy-ridden buildings into office condos.

“Office condos are having their moment,” said Rudder, who has a vested interest in the submarket: His firm solely focuses on office condo sales.

The submarket still faces plenty of issues. Many companies already have long-term leases in place, making it difficult for them to leave and buy new space. Conversions of traditional offices to condos also need to be approved by the New York Attorney General’s office, a process that can take up to nine months, according to Rudder.

Other industry experts say they have yet to experience a crazed rush to convert troubled office buildings.

“I haven’t seen a lot of that,” said Jonathan Mechanic, who heads Fried Frank’s Real Estate Department and has represented some of the largest developers and lenders in New York.

That’s not to mention the lingering questions about the overall office market, including whether anyone is actually interested in taking on space in a lower-quality building.

“Anything below (Class) A is going to struggle,” said Dan McNamara, the founder of the hedge fund Polpo Capital that is shorting an index of mortgage bonds backed by malls, offices and hotels. “It’s so obvious. Walk around Midtown Manhattan.”

The ugliest building

Rudder said the office condo market has come a long way since he launched his firm in 2010.

One of his first clients was Ken Smith, a famed landscape architect, who was looking to buy a new office.

“He called me and said I want to buy the ugliest space in Manhattan,” said Rudder.

Rudder eventually found a place that Smith deemed unsightly enough: 450 West 31st Street, a 12-story brick building accompanied by a smokestack on the far West Side that’s currently home to The Real Deal’s office. Smith bought a unit in a building — a co-op, which looks as if it was picked up from a depressed Midwestern industrial city and dropped two blocks west of Penn Station — for $2.6 million, or $220 per square foot, according to Rudder.

Shortly afterwards, the building sold air rights to a development next door. Some of the money was used to make improvements to the rest of the property.

The brick building is now sandwiched between shiny Hudson Yards skyscrapers, sitting in front of a Whole Foods, a Sweetgreen and an Equinox.

In order to acquire the property, a new developer will likely have to buy out the individual unit owners, an added advantage for buyers that is hard to account for when making the initial purchase. Rudder estimates Smith’s unit is now worth around $10 million.

“You can’t really put that in your underwriting,” said Rudder.

Read more

Conversion opportunity

While the office condo market has performed better than the traditional office market, it’s still suffering from many of the same problems.

By the end of 2021, the average price per square foot for office condos was $723, up 19 percent from $608 in the first half of 2021, but 11 percent lower than the five-year average of $812 per square foot, according to data from Rudder Property Group.

But while pricing is down, availability is tight. There are only about 1 million square feet, or 139 units for sale across 73 buildings, equating to an availability rate of 9.4 percent. Unlike a traditional office lease, buyers are also able to take on mortgages to finance up to 90 percent of their acquisition costs.

Foreign buyers have been among the largest drivers of this market, since they are often more accustomed to owning their space instead of leasing, according to Rudder. These buyers commonly include doctors, dentists or jewelers.

“The groups have historically bought office condos pre-Covid have done well and they see that pricing is down 10-20 perent,” said Rudder.

Non-profits have been large players in the sector as well, because they can take advantage of tax-exempt financing.

Notably, the New York Public Library bought eight commercial condos at 445 Fifth Avenue for $34.5 million in 2014. The library sold two of its floors in the building in 2019 for over $21 million, and used the money to fund an expansion of its main branch, according to a NYPL spokesperson. Last year, the library sold the remaining six condos it owned for $38 million, a substantial profit for the organization.

Rudder is now pitching condo conversions to landlords with vacant space. Over the next 12 months, he said he expects to submit three to four plans to the Attorney General’s office.

He’s currently working with Aron Rosenberg of R&B Realty Group to convert a 16-story, 87,000-square-foot office property at 32 West 39th Street to commercial condo.

The Midtown South building was hit with a foreclosure suit last year by Maverick Real Estate Partners which has since been resolved, but a number of tenants did not renew their leases.

The property sits near Amazon’s new Fifth Avenue headquarters, the former Lord & Taylor building. Rosenberg is betting that other smaller firms will be interested in buying as the broader office market improves.

“I have always been intrigued in the concept,” said Rosenberg. “There is a significant market for entrepreneurs who look at it the same way: Why pay rent when you can own your own space?”

Office woes

The biggest issue with office condos is perhaps that it still requires a need for office space.

While the widespread distress that many predicted has yet to occur, a number of companies have opted for hybrid or remote work on an indefinite or even permanent basis. Only about 37 percent of New York-area workers went into the office in late March, according to Kastle Systems, which tracks card-swipe data.

Given the broader uncertainty, few investors are willing to pull the trigger on office buys, unless it’s for top-of-the-line property such as One Manhattan West, where Blackstone bought a 49 percent stake last month at a nearly $3 billion valuation.

Average asking rents for Manhattan office space fell 0.6 percent to $68.65 per square foot in the first quarter, marking eight consecutive quarterly declines, according to Transwestern, a commercial property firm.

“The lower quality office market is looking very similar to regional malls, there is a fundamental shift in how we work,” said Polpo Capital’s McNamara.

Some developers are even considering converting their spaces to residential use. Late last year, Vanbarton Group started pitching its glass-and-steel 1970’s era office building at 160 Water Street in the Financial District as a potential residential conversion.

Of course, Rudder sees some of this distress as an opportunity.

“We are seeing major vacancies in buildings where there are no tenants in sight to lease it up, so they hire us to convert to condos and sell it,” he said.