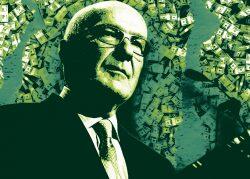

In the latest sign of how far retail values have fallen, Joe Sitt’s Thor Equities lost a commercial condo at the base of Midtown’s Row NYC Hotel, which was valued at a big writedown.

Thor lost the roughly 27,000-square-foot property at 700 Eighth Avenue through foreclosure to a debt fund controlled by Albert Behler’s Paramount Group, which had lent $80 million against the property, a source familiar with the transaction told The Real Deal.

The retail condo was valued at a little more than $45 million, property records filed with the city Wednesday show.

That’s a markdown of nearly 30 percent from the $64 million Sitt shelled out for the property in 2014. And it’s less than half of the roughly $100 million Thor was asking for the condo when it put it up for sale a year later.

Representatives for Thor and Paramount did not immediately respond to requests for comment.

Read more

Thor bought the retail at the base of the Row (then known as Milford Plaza) eight years ago from Highgate Hotels and Rockpoint Group, which had just completed a two-year, $140 million renovation of one of the city’s largest hotels.

It was a different time for the city’s retail market: Tenants were signing leases at prices that seemed like they would never stop climbing, and investors were writing equally eye-popping checks to get in on the action.

Just 13 months after buying the property, Sitt put it up for sale, asking north of 50 percent more than what he had paid the year before. His major tenant was the City Kitchen food court, which positioned itself to draw in hungry tourists and commuters shuffling around the Theater District and the Port Authority Bus Terminal.

But retail rents had actually peaked in 2014, and the market slipped into a deep correction that was compounded by a broader shift toward e-commerce.

The fallout from the market drop is being felt now, as major properties are trading at big discounts to previous prices. Brookfield Property Partners last year sold its retail condo at 530 Fifth Avenue to a partnership between Aurora Capital Associates and hedge funder Edmond M. Safra for $192 million — roughly a quarter less than the $250 million it paid in 2014.

Also last year, Vornado Realty Trust sold off a group of five struggling retail properties for about $185 million, roughly half what it paid to acquire the properties between 2004 and 2006.