A group of ingenious real estate dealmakers returned to Midtown this week to find out who among them brokered the most ingenious deal last year.

After two years as a virtual proceeding, the Real Estate Board of New York’s annual ceremony honoring the year’s most creative commercial property deals was back in person this week at Convene’s space at 117 West 46th Street.

Woody Heller, REBNY’s vice chairman, emceed the 78th iteration of the group’s “Most Ingenious Deal of the Year” gala, which featured brief remarks from Douglas Durst. Honors were given in the categories of financing, leasing and sales, with the three winning deals then ranked in terms of ingenuity.

Douglas Durst (REBNY)

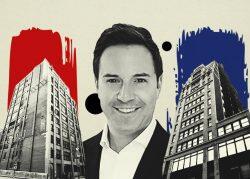

CBRE laid claim to two of the evening’s three honors for the second year in a row, but the top prize went to Eric Anton and Nelson Lee of Marcus & Millichap for their adventures selling the leasehold interest at the then-shuttered Martinique Hotel at 1260 Broadway in Koreatown, which was considered worthless, Heller remarked.

Anton and Lee’s journey took them through karaoke bars and ping pong parlors of neighboring buildings to demonstrate the potential of multi-level retail to the buyer, Oklahoma City-based developer Burnett Equity, which sealed the $55 million deal in November thanks to a mutual interest in beekeeping with the seller, Heller said.

Among the challenges facing Anton and Lee: The leasehold mortgage had fallen into default after its owner died in 2020, the New York Post reported.

Accepting the award, Anton called it the most important of his life, and recalled an early scholarship from REBNY that helped him get started in the industry.

“I come from humble beginnings,” he said.

Closing $1.25 billion in financing for an office conversion with no pre-leased tenants — 18 months into the pandemic, when Manhattan office rents had just hit at a four-year low — was good enough for second place.

From left: Nelson Lee and Eric Anton of Marcus & Millichap, Tom Traynor and James Millon of CBRE Capital Markets and Jarod Stern of Savills (REBNY)

James Millon and Tom Traynor of CBRE Capital Markets shared the prize for best financing deal for procuring the massive construction loan led by Blackstone, Goldman Sachs and KKR on the Terminal Warehouse at 261 11th Avenue in West Chelsea.

“Every spec bet on New York offices would have been more challenging” had that loan not closed, said Traynor, who called the financing a victory for the brokerage community.

Taking third place, Jarod Stern of Savills effectively unionized 28 gem merchants to act as a single tenant that would command the attention of their landlord at 608 Fifth Avenue.

“Rather than represent each small tenant individually with no negotiating leverage, the broker convinced them to operate as a 35,000-square-foot industry group,” Heller said.

The resulting leasing agreement allowed tenants to leave the group if they found the terms unfavorable. Stern shared the award with Michael Affronti of CBRE, who represented the Korein family, the property’s longtime owners who took control of the building after Vornado walked away from its ground lease in 2020.

Read more