When God closed the door on a Manhattan strip club, he opened a window for lenders to fight for control of a real estate portfolio allegedly worth over $200 million.

Scores, the notorious Chelsea gentlemen’s club that inspired the 2019 film “Hustlers” but was shuttered by the pandemic, is one of several properties owned by Robert Gans. In a lawsuit filed this week, the real estate investor alleges a “sweeping and predatory scheme” on the part of his lender, Eli Tabak’s Bluestone Group, to turn a $5 million equity loan into an epic windfall.

Gans seeks $100 million in damages on claims that several companies “controlled by members of the Tabak real estate family” have “conspired with each other” to sell his sizable real estate portfolio out from under him. Eli Tabak did not respond to requests for comment.

Gans’ assets include the building that houses Scores on West 28th Street, a retail property in Soho and 32,000 square feet of industrial property in Queens. But the jewel of his portfolio is a 57,700-square-foot assemblage between West 45th and West 46th streets on 11th Avenue in Hell’s Kitchen. Gans also owns a smaller parcel across 11th Avenue with 150,000 square feet of development potential.

Bluestone’s quest for leverage over Gans culminated last week, according to court documents, when it bought the senior loan on his portfolio for $148 million. The deal followed a flurry of lawsuits brought by Bluestone against Gans’ former senior lenders, Mack Real Estate Credit Strategies and Axos Bank. PincusCo first reported the sale of the senior loan.

Mack initiated a foreclosure on a $130 million refinancing loan tied to the portfolio in October, alleging that Gans had missed $6.6 million in payments.

Bluestone’s leverage over Gans began with a $17 million mezzanine loan originated as part of the Mack-led refinancing in 2018, but the Tabak family’s strategy to seize Gans’ portfolio kicked off later, he claims, when Bluestone called in a separate $5 million preferred equity agreement at a time when the pandemic had cut off Scores’ revenue. The equity agreement allowed Bluestone to foreclose if the equity investment wasn’t repaid.

Read more

In an allegedly coordinated gambit last August, Bluestone sued Gans’ senior lenders in an attempt to void its $130 million mortgage, positioning it to purchase the loan at a “significant discount,” Gans claims. Bluestone also obtained equity in the Scores building — a property that was allegedly in contract last summer for $27 million — for a mere $100,000, according to Gans, through a foreclosure sale of its $5 million equity investment.

The city’s record of the transaction, however, puts the price Bluestone paid for a stake in the Scores building at close to $3 million.

A judge dismissed Bluestone’s effort to void the senior mortgage in March, ordering it to pay the other side’s legal fees.

Gans wants $100 million in damages from Bluestone, alleging that its maneuvers have muddied the financial waters and prevented Gans from reconciling his debts.

Gans also accuses Bluestone affiliates of “secretly” negotiating lease terms for 605 West 45th Street, a property that forms part of a larger assemblage but is not collateralized by Bluestone’s interests. Gans currently leases the property with an option to buy it.

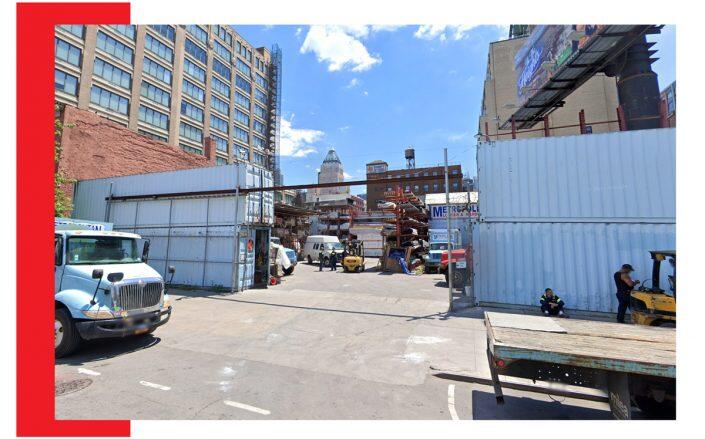

616 11th Avenue (Google Maps)

One path for Gans to deal with his growing debt is to sell his holdings. He claims he is trying to do just that. Commercial brokerage JLL is marketing Gans’ 616 11th Avenue, where he owns Metropolitan Lumber & Hardware, as a development site. A JLL broker said the property had “many interested parties.”

“We want to continue operating the lumber yard at present,” said Gans, “but we have received many offers for joint ventures that likely would involve upzoning and redeveloping the property to create substantially more value.”