New York City’s office market is improving every month, but what it will look like a year from now is anyone’s guess, Vornado Realty Trust’s management said Tuesday.

Vornado’s shares rose roughly 2 percent after the company reported first-quarter earnings and revenue that beat Wall Street consensus expectations. Funds from operations per share, a key REIT earnings metric, increased more than 20 percent year over year to $0.79 on an as-adjusted basis, beating the consensus estimate by 3 cents. Net operating income ticked up 3.1 percent.

Year-to-date, the company’s stock is down a little less than 12 percent, slightly outperforming the broader market.

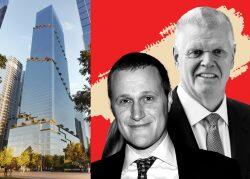

Rising interest rates, meanwhile, are weighing on the company’s earnings outlook for the year, chairman and CEO Steven Roth told analysts on an earnings call. The company had expected to deliver double-digit FFO growth in 2022, driven primarily by previous office and retail leasing and a continued recovery of its variable businesses like signage and trade shows.

“We have more floating-rate debt than most, and that strategy is correct nine out of every ten years — but this is the tenth year,” Roth said. “The economy is now in the hands of the Federal Reserve and their role as an inflation fighter.”

Office leasing velocity in the city is materially higher this year compared to last, employees are returning to offices in greater numbers each week and tenant concessions have stabilized, the REIT’s management said on the Tuesday call. As of early May, Vornado’s New York office buildings were about 46 percent utilized.

“In terms of predictions of what utilization will be a year from now? It’s anybody’s guess — higher,” president and CFO Michael Franco said.

Vornado’s pivot to asset sales — it is planning $750 million worth this year, including both office and retail property — suggests parts of the market have atrophied and the REIT is still playing defense. It is trimming where it expects it won’t be able to significantly push rents, Franco said.

The company most recently struck a $173 million deal to sell its Center Building office property in Long Island City. In the Financial District, it plans to bring the 29-story office building at 40 Fulton Street to market soon, Franco said.

“We’re going to prune the portfolio,” he said. “We’re going to continue to upgrade.”

In sum, Vornado completed 30 leases for 272,000 square feet of New York City office space during the first quarter at a rate of around $81 per square foot and for a weighted average lease term of 8.8 years. A “flight to quality” remains the dominant theme; 40 percent of the first-quarter leases were for relocations to new or redeveloped assets.

Glen Weiss, executive vice president for office leasing, described Manhattan leasing activity as lumpy overall in the first quarter.

“It’s not a one-size-fits-all answer,” Weiss said. “It’s very tenant-specific. It’s very industry- and sector-specific.”

Read more