Rudin Management handed off a Financial District building after nearly 60 years, selling the 30-story office property to a pair of developers.

Silverstein Properties and Metro Loft Management teamed up to buy 55 Broad Street for roughly $180 million, the Commercial Observer reported. The landlords have inked a contract, but the closing date remains unclear.

The Rudin family developed the 425,000-square-foot property in 1967, intending for it to be the headquarters for Goldman Sachs, which left in 1983. In 2019, Rudin completed a renovation that included a new lobby.

In 2016, Rudin refinanced the property with a $60 million loan from State Farm.

Tenants at the building include French engineering firm Systra and Curtis + Ginsberg Architects. In 2020, charter school network Uncommon Schools signed a deal to take 42,000 square feet for a 15-year lease. Asking rent for the space was $48 per square foot.

Read more

An Eastdil Secured team including Gary Phillips and Steve Binswanger advised Rudin on the sale.

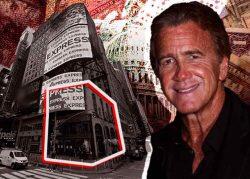

The sale comes months after John Gilbert, Rudin’s former chief technology officer and chief operating officer, stepped down after three decades with the developer. In an interview with The Real Deal, Gilbert noted 55 Broad has been called “the godfather of smart buildings.”

Last month, Silverstein closed on a $457.5 million refinancing of 7 World Trade Center. Tax-exempt bonds make up $449 million of the loan. Goldman Sachs led the deal, which was executed in green bonds, a kind of financing for projects with environmental benefits; the office tower has LEED Gold status.

Metro Loft and Silverstein recently found themselves on opposite ends of a sale. In December, Silverstein bought a 400-unit apartment building at 116 John Street from Nathan Berman’s Metro Loft for $248 million. A decade earlier, Berman joined forces with Hacienda Intercontinental Realty to convert the 35-story building into apartments, removing one of the last remaining office towers on John Street.

[CO] — Holden Walter-Warner