Our buildings are fine. It’s everyone else’s that are in trouble.

You’ve probably heard versions of this claim from major office landlords over the past two years as the shift toward distributed work led many to question how those assets could possibly hold their value.

For a time, the investment-sales market for office buildings was on ice, so both doomsdayers and optimists had to wait. Every new lease, meanwhile, was celebrated as a sign that normalcy was on the horizon. Landlords and their boosters tried every argument in the book to bring people back, from civic duty (Jeff Blau and Mayor Eric Adams) to productivity (Marc Holliday) to vibes (Rob Speyer).

But it’s clear that remote work — frequency and proportion will vary — is here to stay. And a new analysis forecasts just how devastating that could be to office building values.

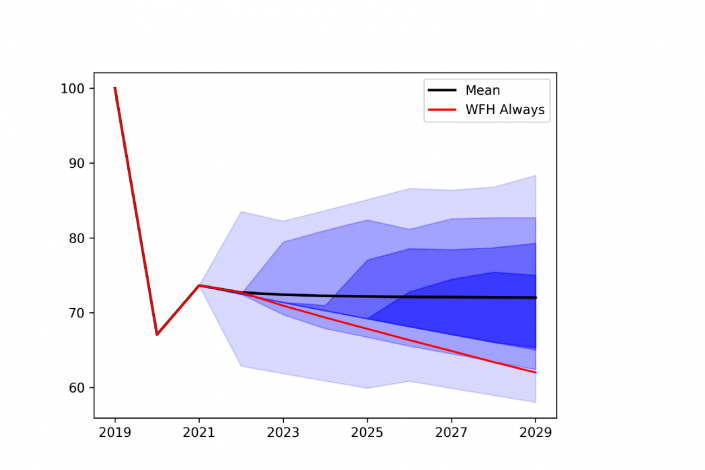

(Source: Gupta, Arpit and Mittal, Vrinda and Van Nieuwerburgh, Stijn, Work From Home and the Office Real Estate Apocalypse, May 31, 2022)

“Work From Home and the Office Real Estate Apocalypse,” by NYU’s Arpit Gupta and Columbia University’s Vrinda Mittal and Stijn Van Nieuwerburgh, attempts to revalue New York’s commercial office stock by “taking into account pandemic-induced cash flow and discount rate effects.”

It finds that by 2029, the city’s office stock will fall in value by 28 percent, or $49 billion, as lease revenue and the number of new leases will drop. Extrapolating to the national office market, the analysis estimates that about half a trillion dollars of value could be wiped out.

“Remote work changes the risk premium on office real estate,” the authors write in a draft released this week. “Office returns, in other words, are now pricing in the risk that remote work might be an important risk for offices.”

The analysis studied lease-level data from CompStak across 105 office markets. It found an 8-percentage-point decrease in lease revenue from January 2020 — right before Covid — to December 2021. The entire drop, the authors state, was from lower lease volume rather than lower rents.

Read more

“Rents may not have bottomed out yet,” the paper states, noting that 66 percent of leases in the U.S. and 73 percent in New York have not come up for renewal since the start of the pandemic, and that vacancy rates are already at 30-year highs in several major markets (20.4 percent in New York in 2021’s fourth quarter.

Occupancy provides another hint at where things are going: Key card swipes at New York metro area offices were down by 62 percent since early 2020 as of mid-May, according to Kastle Systems data cited by the Wall Street Journal, and by an average of 57 percent in other metros.

There are some bright spots, however, for landlords who own the best buildings. The much-ballyhooed “flight to quality” is playing out across the skyline, the paper concludes. “Their rents on newly-signed leases do not fall or [they] even go up, in contrast with the rest of the office stock,” the authors write. “By contrast, lower quality office stock appears to be a more substantially stranded asset, given lower demand, raising questions about whether these assets can be ultimately repurposed towards other uses.”