Two luxury rental buildings on the Upper East Side fetched about 40 percent of the cash in last month’s 10 largest Manhattan real estate loans.

Rental buildings also drew large loans in the West Village, as renters paid a record average of $4,000 in May to live in the city’s central borough.

The 10 largest Manhattan real estate loans recorded in May totaled $1.5 billion, lower than April’s $1.7 billion, and $1.8 billion from a year ago.

Here are more details on the lending packages, ranked from the biggest:

1. Cha-ching | $714 million

Chetrit Group and Stellar Management scored $714 million in CMBS debt to refinance and renovate two luxury rental buildings on the Upper East Side: Yorkshire Towers at 305 East 86th Street and Lexington Towers at 160 East 88th Street. Bank of Montreal, Starwood Mortgage Capital and Citi Real Estate Funding originated $539.5 million in senior and subordinate loans. There is also $174.5 million of mezzanine debt.

Chetrit and Stellar will use the loan to extract $55.3 million in equity, according to Morningstar DBRS. The CMBS debt has a 10-year, interest-only term with a rate of 3.04 percent for non-mezzanine notes and a weighted average rate of 7.26 percent for mezzanine notes.

The financing replaces a $550 million loan provided by Natixis and UBS in 2017. Chetrit and Stellar purchased the properties for nearly $500 million in 2014.

2. Room discounts | $239 million

Sonesta International Hotels secured $239 million from Ramsfield Hospitality Finance and funds managed by CarVal Investors to acquire the Benjamin, the Shelburne Hotel & Suites, the Gardens Suites Hotel and the Fifty Hotel & Suites.

Sonesta bought the four hotels for $324 million from Denihan Hospitality Group, which will retain a minority interest in the properties. Denihan refinanced the four hotels with a $320 million loan from Goldman Sachs in 2016, suggesting a decline in value of about 25 percent assuming the same loan-to-value ratio.

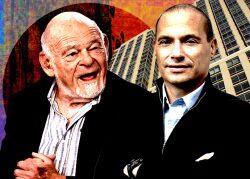

3. Old school | $180 million

Aby Rosen’s RFR Holding and Penske Media Corporation nailed down $180 million from Citibank and JPMorgan Chase to buy 475 Fifth Avenue for $290 million, or about $1,315 per square foot.

Penske, which publishes Variety and Rolling Stone and is headquartered at the building, contributed 50 percent of the equity for the purchase. Total financing for the acquisition came to $260 million with PCCP providing mezzanine debt, Commercial Observer reported.

4. Uptown dreamin’ | $79 million

Taconic Partners, Nuveen Real Estate and Flatiron Equities received $78.8 million from Ares Commercial Real Estate to redevelop 309 East 94th Street and 324 East 95th Street in Yorkville. The three firms bought the Upper East Side properties, with a development potential of 205,000 square feet, for $70 million in late 2021. Plans to dig test pits at the site were filed with the Department of Buildings in May.

5. Shopping in the Village | $64 million

John Usdan’s Midwood Investment and Development got $63.5 million from Metlife Real Estate Lending to buy Candela Tower, a 158-unit apartment building at 56 Seventh Avenue in the West Village, for $102 million. Blackrock was the seller.

Read more

6. Fruity funding | $60 million

Jeffrey Gural’s GFP Real Estate received $60 million, including $4 million in new funds, from Apple Bank to refinance 200 Varick Street, a 490,000-square-foot office building in Hudson Square. The loan replaces debt held by Wells Fargo. The building is 91 percent leased, Commercial Observer reported.

7. Shovel-ready | $41 million

Isaac Tshuva’s Elad Group landed $40.9 million from Valley National Bank to buy a development site at the corner of Third Avenue and East 74th Street in Lenox Hill, where plans are approved for a 33-story residential building with only 47 units. A joint venture of Premier Equities, Continental Ventures and Thor Equities sold the site at 1299 Third Avenue, where the 140,000-square-foot building is planned, for $61 million.

8. Artsy deal | $40 million

JMC Holdings received $40.2 million from Granite Point Mortgage Trust to refinance the Interior Arts Building, at 306 East 61st Street in Lenox Hill. The funds replace debt held by Square Mile Capital. JMB bought the 58,000-square-foot building for $47 million in 2018.

9. Parking payout | $40 million

Alf Naman’s eponymous firm borrowed $39.5 million from First Citizens Bank to buy a 40,000-square-foot parking garage at 738 Greenwich Street. West Village Houses, a co-operative of 42 low-rise residential buildings that urban preservationist Jane Jacobs championed, sold the garage for $64.2 million.

The co-op had rejected a bid from Madison Equities in 2017 to buy and raze the 420 co-op units. Proceeds from the sale of the garage, made possible by an exemption to the city’s off-street parking rules, were used to pay down debt and fund capital repairs.

10. Back to the office? | $36 million

Steven Mashaal’s Skyway Development received $36 million from Metropolitan Commercial Bank to refinance a 77,000-square-foot office building at 30 West 21st Street in Flatiron. Skyway bought the building for $38.5 million in 2013. WeWork is a tenant on the second floor.