Nelson Management and its partners are looking to sell a large multifamily portfolio in the Bronx for more than $200 million.

The owners have put their Lafayette Boynton and Promenade Nelson apartment complexes, which count roughly 1,300 units combined, up for sale with a whisper price north of $200 million, The Real Deal has learned.

The properties are covered by an agreement under the state’s Article XI program, which provides landlords an exemption on their property taxes in exchange for investing in their buildings and making improvements. The apartments are subject to rent stabilization.

That limits an owner’s ability to increase revenues by pushing rents, but it also provides an element of stability: the buildings remained 99 percent occupied at the height of the renter exodus at the beginning of the pandemic, according to a person familiar with the properties.

Representatives for Nelson Management and its partners — JP Morgan Asset Management and L+M Development Partners — could not be immediately reached for comment. Eastdil Secured is marketing the properties.

Read more

The larger of the two properties, the Lafayette Boynton apartments, is a complex of four 19-story towers in the Soundview section of the Bronx with 972 units. The Promenade Nelson is a 32-story tower sitting at the border of Marble Hill and Riverdale with 318 units.

Nelson bought the buildings in 2011 and 2013, respectively, and has invested more than $40 million in the properties. The portfolio is 10 years into its 40-year Article XI agreement.

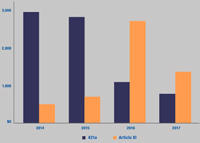

The incentive program has typically been more popular with investors when the 421a apartment project tax break is unavailable. The 421a program expired last week.

The Bronx’s multifamily market just got a shot in the arm when Ephraim and Eli Fruchthandler sold two buildings in Union Port and West Farms for $169 million — one of the borough’s biggest transactions this year.

The Rent Guidelines Board this week approved a 3.25 percent rate hike, the first full-year increase since the onset of the pandemic.