Office landlords are struggling under the rise of interest rates and remote work. Things could soon get worse.

It’s already been a tough year for owners in the office market. An index tracking shares of publicly traded office owners has dropped 29 percent in the first two quarters of the year, the Wall Street Journal reported. That outpaced the 21 percent fall from the S&P 500 stock index.

The pandemic-fueled increase in remote work is a visible enemy of office landlords. Companies embracing remote work are turning away from office space, leaving landlords dealing with high vacancy rates and forcing them to carve out concessions to attract tenants.

Rising interest rates are an issue too, though. As rates increase, property values tend to go down. Green Street estimated that office building values have already dropped 8 percent this year.

More problems could be on the way as recession alarms blare, including companies cutting costs by way of layoffs, reducing the need for office space. Office occupancy fell in each of the last three recessions, according to Moody’s Analytics.

Read more

Distress in the sector could be right around the corner. The share of office mortgages that are delinquent is low because landlords typically hold less debt than before the previous recession. Experts expect more defaults to come soon, though, particularly for properties that are older and cheaper as tenants lead a flight to quality.

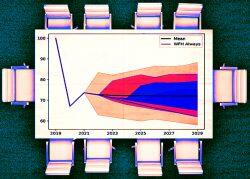

As office landlords grapple with the short-term ramifications of a potential recession, the long-range isn’t looking good either. An analysis from a team at NYU projected that by 2029, New York City’s office stock will fall in value by 28 percent, or $49 billion.

When extrapolated to the national office market, the analysis estimated roughly half a trillion dollars of value couple be wiped out across the sector.

[WSJ] — Holden Walter-Warner