Vornado Realty Trust could secure a tax break worth as much as $1.2 billion if it develops all of the sites surrounding Penn Station.

That’s according to a new report commissioned by watchdog group Reinvent Albany, which says the study is aimed adding transparency to the state’s plan to incentivize the construction of 18 million square feet of commercial space near Penn.

The projects are supposed to help pay for the redevelopment and expansion of the beleaguered station. Empire State Development has not yet released details on how the transit hub improvements will be financed, though it is expected to do so ahead of a key vote expected July 21.

The watchdog’s report, which was written by Bridget Fisher and Flávia Leite of The New School, also found that the state could be short of the $3.4 billion to $5.9 billion it needs to pay for its portion of Penn-related projects.

The Hochul administration estimates that the state will be on the hook for $7.5 billion to $10 billion for redeveloping Penn and building the Gateway passenger train tunnel under the Hudson River. But Reinvent estimates that the net revenue from payments in lieu of taxes, or PILOTs, will only support $4.1 billion in bonds.

The New York Times first published the findings of the report, which treats the terms of each development site equally, though the state will ultimately reach individual agreements with property owners of each site.

The report assumes that the PILOTs will essentially discount property taxes by 20 percent, the maximum amount available in nearby Hudson Yards.

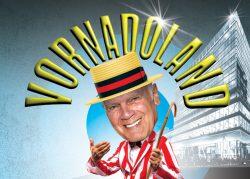

Since the 1990s, Vornado has amassed more than 9 million square feet of office space in the neighborhood and reimagined the area as its own office campus, which it calls the Penn District. The real estate investment trust controls most of the eight sites surrounding the train station, though the state will ultimately take control of the sites and sign ground leases with each property owner.

Vornado would not comment on the report specifically, but a spokesperson said the REIT “is a key partner in this neighborhood and committed to a [plan] that’s transformative for the region and reflects the vision outlined by Governor Hochul and Mayor Adams,” a spokesperson for the REIT said in a statement.

Building group leaders have come to the defense of the venture, and more specifically to the use of “value capture” to fund complex transit projects.

“This is a model of how public-private partnership can successfully deliver countless public realm benefits to commuters and nearby residents alike,” Building Congress President Carlo Scissura said in a statement.

Read more

A spokesperson for ESD lamented that the agency did not have the opportunity to review the report before it was released and said that as a result, “it’s difficult to comment on its accuracy.”

“It’s disappointing that an organization that considers itself a citizens’ watchdog would prefer Penn Station remain a junkyard, denying New Yorkers the significant affordable housing, open space and desperately needed transit improvements this plan provides,” the spokesperson said in a statement.