Douglas Eisenberg’s A&E Real Estate closed on its latest Upper West Side apartment deal with a $286 million loan from Square Mile Capital Management.

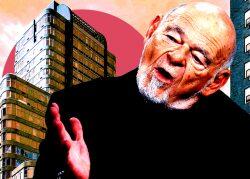

Square Mile said it provided the financing for the 33-story, 455-unit building at 160 Riverside Boulevard, which A&E bought from Sam Zell’s Equity Residential last month for $415 million.

It’s the second apartment building on Riverside Boulevard formerly known as Trump Place that A&E bought from Equity Residential this year. In April, Eisenberg’s firm paid $266 million for the 354-unit building at 140 Riverside Boulevard.

Together with the 500-unit 180 Riverside Boulevard, which Equity Residential still owns, the three buildings make up the complex formerly known as Trump Place, which was rebranded “to assume a neutral building identity” in 2016 after residents petitioned to drop the Trump name.

Read more

One of New York’s largest apartment landlords, A&E has spent more than $1 billion expanding its rental portfolio in the city this year alone. In addition to the Riverside Boulevard purchases, it reportedly reached a $250 million deal with the LeFrak Organization in April to buy 14 properties spanning 1,217 mostly rent-stabilized units in Brooklyn’s Gravesend and Sheepshead Bay neighborhoods.

In February, A&E paid $130 million to buy the 22-building, 1,000-unit Cunningham Heights apartment complex in Queens Village from Long Island-based Benjamin Companies in Queens’ largest multifamily deal since the start of the pandemic.