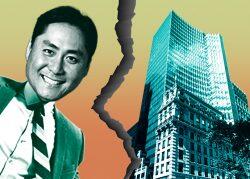

Thor Equities wants the money it claims to be owed at 212 Fifth Avenue, and has turned the attention to an insurer to get the millions.

Joe Sitt’s firm sued Hiscox on Wednesday for failing to cover $3.4 million the firm alleges Madison Equities CEO Robert Gladstone stole from the luxury condo project, the Commercial Observer reported. The money was allegedly taken by Gladstone without permission after all 48 units at the building were sold.

In 2019, BLT allegedly told Thor that it was owed $3.4 million from condo sales. Thor and Madison ended up locked in discussions over the money before Gladstone agreed to pay more than $3.6 million in December 2019, the original sum plus interest.

A judge previously ruled that Gladstone needed to pay the money, but allegedly has yet to do so. Thor is instead asking Hiscox to foot the bill because its insurance policy protects from theft.

Thor argued the “employee theft” clause applies because Gladstone was the one member of an entity formed by the two developers to manage the property. The entity has a 4.3 percent stake in the property, while Sitt has a less than 2 percent stake; the majority stakeholder is co-developer Building and Land Technology.

Hiscox has countered, claiming the entity is not technically a subsidiary of Thor and therefore doesn’t qualify for coverage. Hiscox has also refuted that Gladstone is an employee because of an ownership stake.

Read more

The insurer has additionally questioned whether Gladstone stole the money, drawing accusations from Thor that Hiscox is stalling.

There have been a number of lawsuits at the luxury condo building, home to the likes of Jeff Bezos and Charles Kushner.

In 2017, the development team sued Town Residential, claiming it didn’t meet sales targets and resisted being replaced. The suit was settled and Madison brought in a team from Sotheby’s International Realty to replace the now-defunct brokerage.

Another lawsuit involved a group of investors, who in 2020 claimed Gladstone mismanaged the project’s finances and misappropriated funds. Shortly after the dispute, the investors reached a $1 million settlement with Gladstone.

— Holden Walter-Warner