The marriage between office buildings and pension funds has grown stale in recent years, and the two parties are moving on.

Pension funds are ditching their office assets as the market continues to decline from pandemic-induced stresses and the rise of remote work, the Wall Street Journal reported. The retirement funds are instead turning their attention to residential and industrial plays.

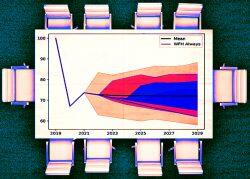

Private real estate funds held 34 percent of their investments in offices three years ago, according to an index from the National Council of Real Estate Investment Fiduciaries. That number is down to 23 percent and retail holdings also dropped seven percentage points in the same period.

Oxford Properties, the real estate arm of the Ontario Municipal Employees Retirement System, is one of the companies reducing its office holdings. President Michael Turner suggested the office share of its portfolio, which was 44 percent only six years ago, could drop from 25 percent to 20 percent in the next decade.

One example of Oxford’s shift made headlines, as 550 Washington Street in Manhattan sold to Google in September for $2.1 billion. The purchase marked the biggest sale of an office building since the pandemic, not only in New York City, but in the entire United States.

Read more

The industrial and residential sectors emerged as winners in the wake of the pandemic, and the funds seem to have taken notice. Industrial properties account for 31 percent of their investments, up from 18 percent in 2019. Infrastructure assets, including airports, are also making small gains.

Office vacancies became a national concern as the pandemic emptied major business districts, but the Wall Street Journal previously reported analysts and investors trace the origin of the glut of space back to a Ronald Reagan era tax change. There likely isn’t good news on the horizon, however, as rising interest rates are threatening property values and the office index from the stock market has plummeted in recent months amid fears of a recession.

— Holden Walter-Warner