New development activity is back in New York, and the roar of construction has awakened a dreaded industry bogeyman: the holdout.

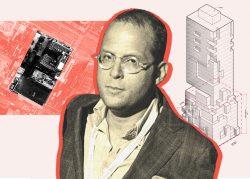

From the Diamond District to Billionaires’ Row, neighbors and tenants have dug in their heels and hobbled major projects. Perhaps the starkest example is playing out at Miki Naftali’s Upper West Side condominium conversion at 215 West 84th Street.

In February, the developer sued Ahmet Ozsu, the sole remaining tenant in the 16-story apartment building on the site, alleging that Ozsu’s refusal to move has cost him $25 million in lost rent and profits.

But that hefty price tag doesn’t tell the full story. There are financing and operational costs to be considered, as well as legal fees and a great intangible: reputational damage.

All of them must be weighed against the high price, but relative simplicity, of buying out a tenant or paying off a pesky neighbor.

So just how much can a holdout cost? The Real Deal put together a breakdown.

“The only sure thing”

Developers up against a stubborn tenant have to make a call: buy the renter out or sue them.

Overwhelmingly, attorneys recommend the former.

“We say to developers that the only sure thing is a buyout,” said Sherwin Belkin, founding partner at Belkin Burden Goldman. “Here’s your check. Goodbye. Don’t let the door hit you on the way out.”

The downside is that buyouts are pricey. Attorneys have claimed they’ve gotten anywhere from $750,000 to more than $2 million on behalf of holdouts in recent months. Those sums can run higher, depending on the scope of the blocked project.

Tenant lawyer David Rozenholc famously scored $25 million in 2015 for two renters standing in the way of Tishman Speyer’s $3.2 billion Hudson Yards office tower, the Spiral.

The only sure thing is a buyout. Here’s your check. Don’t let the door hit you on the way out.

Faced with those figures, some developers do choose to take the battle to the bench.

When dealing with rent-stabilized tenants, an owner can file an application with the state for permission to demolish the property and the right to refuse a lease renewal. But that approval depends on wins in two courts: New York State Supreme Court and New York City Housing Court.

If, like Naftali’s holdout, a tenant isn’t protected by the rent law, an eviction suit can do the trick. But real estate attorneys caution that a lawsuit isn’t always the quickest or cheapest solution.

“Litigation is always a crapshoot,” said Belkin. “You may have an absolute right to win, but that win can take a year, two, three, five.”

“With a buyout, you’re buying time,” he added.

And time, particularly in new development, is money.

The breakdown

Take Naftali’s project. The developer did not return a request for comment on his expenses, but some back-of-the-napkin math offers clues.

First, there’s mounting interest on project loans. Naftali bought the 84th Street site last summer for $71 million, funding the majority of the purchase with a $44 million mortgage, records show.

At the time, commercial mortgage rates ranged from 2.1 to 6.6 percent, according to Commercial Loan Direct. Assuming Naftali nabbed a rate at the midpoint, 4.3 percent, the firm would be paying $1.9 million in interest annually, or more than $5,000 a day.

Add that to the price of keeping the building running.

The Community Housing Improvement Program, a landlord trade group, recently broke down the operating costs for buildings with rent-stabilized units, including properties that are 95 percent market-rate.

CHIP’s data pegs maintenance, fuel, labor, utilities and insurance at $6,200 per year per tenant, on average. And although just one tenant remains, Naftali is likely on the hook for keeping the whole building online.

“The tenant has a right to full habitability, meaning all the services the tenant got when the building was full, the tenant still has the right to get now,” said Adam Leitman Bailey, the attorney representing Ozsu in the Naftali case. Bailey declined to comment in more detail, citing ongoing litigation.

Those expenses could run as high as $795,000 per year, or $2,178 per day for Natfali. Tack on the annual property tax bill of $822,000, according to public records, and that adds another $2,252 per diem.

Between financing and operations, Naftali could be spending nearly $10,000 daily.

Boardroom bills

Belkin said he’s seen developers pay legal teams several hundred thousand dollars to get a stabilized tenant out and a building demolished. Take the midpoint of those estimates and that amounts to $200,000 over four years, or $137 per day.

Naftali isn’t taking the same type of legal action — he’s suing both for damages and to evict — but his approach similarly requires navigating two courts.

What’s uncertain is how long those cases will take, and therefore, how expensive they will be.

The developer first sued to evict Ozsu in January. Earlier this month, a housing court judge ruled the renter could stay in the apartment so long as his rent relief application is pending.

Some landlords who applied for rent relief when the portal opened last summer are still awaiting an approval or rejection. A survey of over 230 landlords found that on average, tenants received a decision in about seven months.

Ozsu’s application has been pending for nearly that long. If it’s denied within the next few weeks, Naftali’s legal fees could be in the neighborhood of $30,000.

But if it’s approved, Ozsu will have secured a year’s worth of eviction protection, which would likely mean another year of litigation, bringing legal expenses closer to $80,000.

Opportunity cost

Another bag of losses is unrealized returns.

In Naftali’s case, the developer can’t pull in rents on a next-to-empty building. But he’s also losing money on stalled condo sales.

“Every day becomes more expensive for the developer with no additional benefit,” said Steven Wagner, a condo law specialist who joined Bailey’s firm this year.

Part of that cost is what Belkin calls “the lost use of dollars.” If the development wraps in a year, the developer can reap profits sooner and invest that money elsewhere.

And there are shifts in market value to account for. Naftali plans to build 45 luxury condos on the 215 West 84th Street lot.

As of mid-August, the Olshan Report found the average asking price on a condo was about $6.8 million. For Naftali, that would amount to $308 million in potential sales.

But the city’s luxury market is slowing. Just eight contracts for units priced at $4 million and above were signed the week of Aug. 15, according to Olshan. Given the likelihood of a recession, the longer Naftali must wait to build, the more likely it is that he’ll have to sell in a down market.

Every day becomes more expensive for the developer with no additional benefit.

Those conceived losses on profits seem to be part of the $25 million Naftali is seeking from Ozsu in court.

The bottom line

In the end, a developer’s decision to litigate may be pricier than an upfront payout.

Attorneys say they can typically finish buyout negotiations in three months, unless the tenant is determined to play hardball.

“When I’m working on the landlord side, I’m in a rush,” said Bailey, Oszu’s attorney. “I understand that I need to spend money because I understand the cost of money each day that tenant is in possession.”

Had Naftali negotiated with Ozsu in that three-month timeframe, he’d have lost $900,000 in interest payments and maintenance costs, according to the $10,000-per-day calculation, and avoided litigation fees.

Ozsu told the New York Times he turned down a $30,000 buyout offer. Naftali declined to comment on that offer, but claims Ozsu is seeking a seven-figure payout.

If Naftali had agreed, he’d be down about $2 million. That’s less than half the estimated $4.3 million he may have lost to financing, operations and legal fees during the ongoing 14-month battle, which begs the question: When is it time for a developer to cut his losses?

“It gets to a point where, unless you are so well-heeled that it doesn’t matter, it does matter,” Wagner said.

Read more