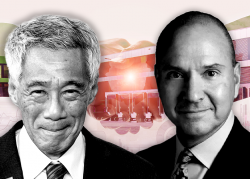

A foreign wealth fund and a U.S. partner cast a billion-dollar wager on suburbs as the future of offices.

Singapore’s GIC and Workspace Realty Trust bought majority stakes in 53 suburban office buildings, the Wall Street Journal reported. The properties are scattered across the country, but many are concentrated around Atlanta, Dallas and San Francisco.

JPMorgan Chase and Bank of Montreal financed the transaction, which closed on Friday. The seller was Griffin Realty Trust, which will be hanging on to a minority stake in all of the properties.

The transaction valued the properties at $1.1 billion. Workspace’s holdings will nearly double with the deal, adding up to more than 18 million square feet.

The suburban office market struggled as much as its urban counterpart during the early months of the pandemic. However, flexible work arrangements have driven a boost of interest in suburban properties.

In the second quarter, the downtown office vacancy rate surpassed the suburban for the first time in decades, according to CBRE. The suburbs had a 16.8 percent vacancy rate, while downtown was up to 17 percent.

Read more

The deal is the latest bet by Workspace that the shift away from downtown could be permanent. This time last year, the firm landed a $326 million investment from Oak Hill Advisors. The REIT planned to use the debt and equity investment to make another $5 billion in acquisitions in the next five years.

The Singaporean wealth fund has a more diverse array of interests. In November, GIC led the purchase of a 328-asset portfolio from EQT Exeter, a $6.8 billion trade of industrial properties. It marked one of the largest deals in a warehouse market that was still running red hot at the time.

— Holden Walter-Warner