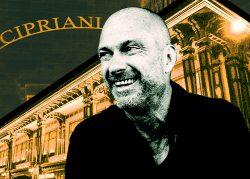

Last call appeared to be in sight for two Cipriani locations, but the Italian eateries are ready to keep the carpaccio coming.

The outposts dodged near-foreclosure by securing a $52.1 million commercial mortgage-backed securities loan secured a modification, the Commercial Observer reported. The senior debt is backed by the Cipriani locations at 110 East 42nd Street and 55 Wall Street.

Cipriani defaulted on its loan in May 2020 and made its last payment in July 2020, according to Trepp data reported by the Observer, moving the loan to special servicing before the foreclosure process was initiated in December 2021.

The hospitality company benefited from New York City’s moratorium on commercial foreclosures and evictions. As it looked to arrange next steps in the wake of the pandemic, a spokeswoman for Cipriani told the Wall Street Journal that its lenders were being “helpful and constructive.”

Cipriani is now working to bring the loan current by making “a significant capital infusion,” and paying down past fees and expenses, according to September special servicing data from Trepp reported by the Observer.

The loan is made up of a $52.1 million senior loan, which accounts for 6.61 percent of the collateral, and a $28 million mezzanine loan on the properties originated by W.P. Carey. Midland Loan Services is the special servicer on the deal.

Read more

Cipriani Wall Street comprises the majority — nearly two-thirds — of the allocated loan balance. Italian nightlife guru and patriarch Giuseppe Cipriani was the borrower of record when the loan was originated.

Cipriani is a staple in Italian dining. The 110 East 42nd Street location features towering marble columns, soaring ceilings, inlaid floors and chandeliers, while its 55 Wall Street location offers a balcony overlooking Wall Street.

Cipriani is also known for Casa Cipriani, its members-only private club in the Battery Maritime Building. Brokers have used private clubs as a means to network, schmooze and dine clients.

In May, Casa Ciprinani received a $100 million refinancing of the Lower Manhattan property.

— Sasha Jones