Good news for real estate agents: The median sale price for homes that sold on Staten Island last month was up 11 percent from a year ago, to $680,000. And they spent 25 percent less time on the market — only 55 days.

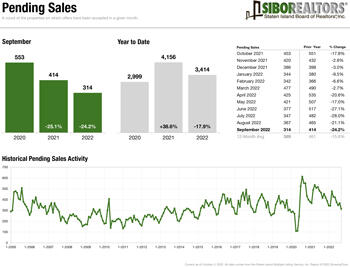

But that was then. This is now: Pending sales, which reflect contracts signed for homes last month, were down 24 percent from September 2021.

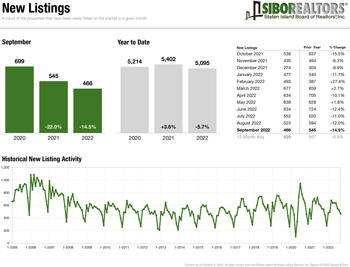

(Sibor Realtors)

The sales figures reflect decisions made roughly two months ago, as home sales take about that long to close. Things have changed since then, notably mortgage rates and Americans’ perception of the economy.

Along with a 12 percent drop in available homes, to 1,553, that explains why fewer buyers signed contracts last month to buy residences. New listings in September were down nearly 15 percent to 466.

Read more

But the slowing pace of the market traces back to about a year ago, when an unsustainable pandemic frenzy of bidding and buying was underway. Closed sales on Staten Island last month were down 19 percent year over year.

The numbers come courtesy of the Staten Island Board of Realtors’ monthly report on the residential market in the “forgotten borough.” Taken together, they indicate that there will be less business to go around for the island’s real estate brokerages.

One statistic that did not change much was months of inventory, which is how long it would take to sell all homes available today at the current pace of sales. The metric edged up 4 percent to four months — not very long.

That is primarily a result of fewer homes being on the market. Sellers have backed off, perhaps because mortgage rates have nearly tripled in the past year, with the average 30-year fixed-rate loan hitting 6.7 percent pmms last week.

(Sibor Realtors)

The higher rates mean buyers on a budget can’t bid as much — monthly mortgage payments are 55 percent higher than they were a year ago, according to the National Association of Realtors — so owners considering selling might be waiting for rates to come back down.

That could be a while, given the upward pressure the Federal Reserve promises to keep on interest rates until inflation is brought back down to 2 percent. Inflation was last spotted lurking in the 8.2 percent range.