Around February 2010, a heavily pregnant Sally Shtrozberg boarded a plane from Israel to New York City to collect on what she said was a $10 million debt.

After landing, she met up with her delinquent borrower in a dilapidated office in Brooklyn, only he told her he didn’t have the money. Outraged, she flipped a table.

The borrower, Joel Schreiber, was peddling major commercial deals in Brooklyn and was about to become WeWork’s first investor. Yet he was telling Shtrozberg he was broke.

Unable to get the money from Schreiber, Shtrozberg said she called Joel’s father, a businessman in London, who flew to Tel Aviv to meet her. According to Shtrozberg, he paid off some of Joel’s debt, but without interest or any returns from the investment. She filed a lawsuit and settled with Schreiber in 2012.

For years, Shtrozberg said, Joel Schreiber would call her just before Yom Kippur, the Jewish day of atonement, to apologize.

When he called, she would hang up.

“Fuck him,” she said. “He ruined my life.”

(Schreiber’s attorney denied that Schreiber’s father had any involvement and said Shtrozberg owes Schreiber money on another loan and an apology.)

But Shtrozberg is not alone. Lenders, investors and brokers big and small have accused Schreiber of owing them money. Barry Sternlicht’s Starwood Capital is going after him for $271.5 million over a loan on an abandoned office building in Downtown L.A. Interaudi Bank is seeking to foreclose on a tax lien on a Billionaires’ Row penthouse his company co-owns. In 2018, Schreiber entered into a bizarre settlement agreement to repay loans issued by North Carolina Mutual, the oldest African-American life insurance provider in the country, which is now in liquidation.

New York real estate is opaque. Investors tend to hide their ownership stakes behind anonymous shell companies registered in Delaware. Most non-public real estate companies are not required to answer to a regulatory authority. Many have gotten rich using these loopholes, which are not illegal, but few are more skilled at this particular game than Joel Schreiber.

What differentiates Schreiber from others is the way he raises money. Often, his funding comes from investors or lenders, sometimes former WeWork executives, with a backing of collateral and a personal guarantee. But a review of lawsuits and loan documents show a common trend: Schreiber often appears to over promise the collateral he pledges.

Most notably, Goldman Sachs alleged in an ongoing lawsuit that Schreiber pledged his WeWork stake for a loan, only for Goldman to find out that he had sold the stock a year before the coworking firm went public. (Schreiber’s lawyer disputes this).

Schreiber is now attempting to buy a 40-story office building in Downtown L.A. for $155 million. And while ousted WeWork CEO Adam Neumann has attracted scrutiny for his own real estate comeback, Schreiber’s could be the one worth watching.

Who is Joel Schreiber?

Schreiber was born in London in 1981. The origins of his family’s wealth are unclear, but he has told people he is close to the Reichmanns, a Canadian Jewish family who owned the multinational real estate powerhouse Olympia & York.

After finishing his Yeshiva studies with no secular education, Schreiber departed for New York around the late 1990s and landed a job at Adorama, a Hasidic-owned camera retailer that competes with B&H Photo.

After finishing his Yeshiva studies with no secular education, Schreiber departed for New York around the late 1990s and landed a job at Adorama, a Hasidic-owned camera retailer that competes with B&H Photo.

But Schreiber soon found his calling in real estate. He flipped a house in New York and began syndicating deals to others through his investment firm Waterbridge Capital.

Schreiber’s skill was in raising money and flipping properties. In 2012, he partnered with now-troubled Redsky Capital to buy an assemblage of properties in Williamsburg for $66 million. That same year, Schreiber and Brooklyn real estate investor David Werner bought One Court Square in Long Island City — Queens’ tallest building at the time — from SL Green and JPMorgan Asset Management for $481 million. Schreiber also acquired an assemblage of properties on North 3rd Street in Williamsburg that included the popular Radegast Beer Hall.

Schreiber’s big break came when he met Neumann and Miguel McKelvey. The story, most recently popularized in an Apple TV miniseries, goes something like this: Neumann and McKelvey pitched Schreiber on WeWork, and Schreiber immediately handed over $15 million for a 33 percent stake.

“Whatever it takes, I want to be a partner with you,” he said, according to a retelling by McKelvey on an episode of NPR’s podcast “How I Built This.”

It was a good story, but the reality was that Schreiber couldn’t commit to the entire amount. In a 2018 deposition, Schreiber said he only invested between $1 million and $2 million in WeWork.

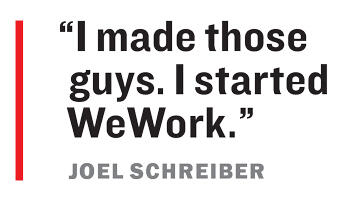

Nonetheless, Schreiber is not shy about his role in Neumann’s and McKelvey’s success.

“I made those guys,” he said in the deposition. “I started WeWork. I seeded WeWork for them.”

In addition to his WeWork investment, Schreiber had deals with Neumann, partnering with him and Alchemy Properties in 2012 to buy the top floors of the Woolworth Building for $68 million for a condo conversion. Schreiber said in one deposition that he still has a fraction of the promote, a fee paid to a developer based on a project’s performance. In another deposition, he claimed to have a $1 billion fund with Neumann for WeWork.

Schreiber deals gave him some level of luxury, including a $2 million house in Brooklyn’s Borough Park and a private driver, but he yearned for a bigger piece of the pie. Like Neumann, he wanted his own capitalist kibbutz. Schreiber teamed up with developer Jackie Jangana and his sisters to buy a historic but dilapidated building in Downtown L.A. for $122.3 million in 2014 with the goal of creating a tech hub.

“We had interest from very large tech companies — the largest tech companies in the world — to take the space,” Schreiber told Dot.LA earlier this year, in a rare statement to the press. “But this is not what the vision was — just to buy a building and put in a tech tenant.”

Double-dipping

Ever since bursting onto the scene in New York, Schreiber has taken a consistent approach to financing his deals, relying heavily on personal guarantees and collateral.

On top of pledging his properties as security for loans, Schreiber also used his stake in WeWork, a tricky move since the company had not yet gone public and its valuation was fluctuating.

In 2016, Schreiber pledged his entire WeWork stake as collateral — held through an entity called We Member LLC — to secure a loan from Neumann. (A loan chart reviewed by The Real Deal shows the loan was $10 million and a person close to the matter said it was eventually repaid.)

There’s nothing unusual about pledging collateral to secure a loan. But pledging the same collateral to multiple lenders can be problematic.

“Most lenders will not allow a borrower to use the same asset as security for a debt unless the asset being used as security is vastly more valuable than the debt,” said Jesse Dean-Kluger, a Miami real estate attorney.

A few months before Schreiber pledged his WeWork stake to Neumann, he pledged a small portion of We Member LLC for a separate $2.1 million loan, according to loan documents bearing his signature.

“There was no double pledge,” Schreiber’s attorney, Michael Fox of the law firm Olshan Frome Wolosky, told The Real Deal.

But Schreiber then started using his WeWork interests for even bigger loans.

In September 2019, he pledged it to Goldman Sachs to secure a $20 million loan. But when WeWork’s first attempt to go public ended in disaster weeks later, it sent the value of Schreiber’s stake tumbling.

Goldman demanded Schreiber hand over new assets to back the loan. Schreiber obliged, except the companies he pledged were worthless, Goldman alleged in court filings. One company Schreiber pledged his interests in, Retail Worx, had already gone out of business, according to PitchBook, which tracks venture capital and private equity.

Goldman alleges that Schreiber’s attorney then told the investment bank that Schreiber had already sold a portion of his WeWork interests, something strictly prohibited under the loan docs. Goldman investigated and found more than 300,000 shares were “dissipated and are unaccounted for,” according to its lawyer.

“Your belief that the collateral is not in place is misplaced and wrong,” Fox told TRD. “The value of the collateral may be different, but those changes, if any, are a cause of the volatility of the market.”

It’s unclear what Schreiber did with the money. In fact, it’s unclear exactly how much money he made off WeWork. In Reeves Wiedeman’s book on WeWork’s fall, “Billion Dollar Loser,” Weideman wrote that Schreiber sold some of his stock to SoftBank for $44.6 million in 2017. Yet in a 2018 deposition, Schreiber claimed to be nearly broke with less than $1 million in liquidity.

To be sure, Schreiber’s marquee asset, The Broadway Trade Center in Downtown L.A., was not generating cash. Despite two refinancings, one from Jamestown for $164 million in 2016 and one from Starwood for $213 million in 2018, the 1.1 million square-foot building had yet to secure a tenant and was literally falling apart.

The property is “susceptible to possible break-ins and vandalism,” Starwood said in one lawsuit.

The building was on and off the market with a price tag of $425 million. Then out of nowhere earlier this year, an obscure startup, EMCEE, whose mission is to “let influencers become true retailers,” announced it would buy the whole building. Dot.LA, who broke the news, reported that Schreiber was a seed investor in EMCEE.

That deal never happened. What happened instead was another issue with pledged collateral.

By May, a lender had filed to foreclose on a small equity stake in the property. It was not Starwood or Jamestown who provided the previous two loans on the property, but a group connected to the seller of the Radegast property in Williamsburg. The lender was seeking to foreclose on an entity that controlled 20 percent of Schreiber’s stake in the property.

The foreclosure auction was called off at the last minute.

Nonetheless, the foreclosure raised questions about why the equity was pledged to another lender and whether Starwood knew about it. Starwood declined to comment.

Shortly after TRD reported on the news of the auction, Starwood initiated a foreclosure on the entire property, claiming Schreiber and Jangana had been in default on their payments for months. To stop the foreclosure, Schreiber put the property into bankruptcy protection — a common tactic — and Schreiber blamed the pandemic for the building’s issues.

But there was a problem. The Jangana family said they never signed off on the bankruptcy. Worse, Starwood said Schreiber was not allowed to file for bankruptcy because of his loan guarantee and sued him personally for $271 million.

“Joel is a victim”

Schreiber’s entanglements are hard to follow.

He borrows money from Goldman, Neumann, former top WeWork executive Ariel Tiger, and an Orthodox congregation, according to loan docs reviewed by TRD.

But of those loans, the most convoluted may be those issued by a reinsurance company.

Schreiber’s signature appeared on two promissory notes totaling $6.5 million in 2015 and 2016 from Port Royal, the reinsurer for North Carolina Mutual Life Insurance, a cornerstone of the historic Black Wall Street in Durham, North Carolina. In 2018, Schreiber reached a settlement with North Carolina Mutual to pay back $3.2 million — an agreement that saw 15 modifications.

The same year, North Carolina Mutual headed into receivership, prompting an investigation by the Department of Justice. The DOJ blamed Brad Reifler, a once high-flying investment manager, for misappropriating North Carolina Mutual’s assets. Reifler was charged for investing its money in high risk and junk investments and diverting funds. He pleaded guilty to one count of wire fraud and was sentenced to five years in prison on Oct. 27.

Reifler’s Forefront Income Trust had loaned money to Schreiber’s entities and Schreiber and Reifler worked in the same office, according to public filings. Schreiber was not implicated in the case or accused of any wrongdoing.

When it comes to Forefront, “Joel is a victim,” Fox said.

Schreiber is still on the grind. He is fighting in bankruptcy court to save the Broadway Trade Center in L.A., claiming to have reached a tentative deal to sell the building to Capri Capital Partners’ Quintin Primo for $325 million. His firm has also made an offer for the Union Bank Plaza building in Downtown L.A.

Shtrozberg wonders how he is still doing deals after all she has been through. Though she settled the lawsuit, she accused Schreiber of ruining her relationship with her father, who thought she stole the money. Under the terms of the settlement, Shtrozberg would forfeit the remaining loan balance if she discussed or complained “in any way” about Schreiber or the agreement with anyone, including his family, court documents show.

She said she met Schreiber again in 2017, at the Ritz Carlton in Tel Aviv, where he asked her to sign a document to confirm she was paid back. She signed it and asked about his newfound fame as the first investor in WeWork.

“I will never forgive him even if he gave me $100 million,” she said.