The Brodsky family has a deal to sell its rental building at the City Point Center in Downtown Brooklyn for a little more than $100 million.

The Brodsky Organization is in contract to sell the 250-unit tower at 7 DeKalb Avenue to California-based Avanath Capital Management, The Real Deal has learned.

The purchase price is only slightly above the $100 million that Brodsky paid in 2017 for the 23-story tower from developers Acadia Realty Trust, Washington Square Partners and BFC Partners.

Read more

The explanation for the only nominal appreciation in value, according to a source, is 7 DeKalb’s large affordable-housing component. Rent stabilization is in place in 80 percent of units at the tower, which is part of the 1.8 million-square-foot, mixed-use City Point development.

Representatives for Brodsky and Avanath were not immediately available for comment. A team at Newmark led by Brett Siegel and Evan Layne brokered the sale.

The deal is expected to close early next year. One factor that helped get it done is that 7 DeKalb has an assumable mortgage — a feature that’s become a valuable selling point given the jump in interest rates this year.

Avanath is taking over the $58 million Wells Fargo loan, which runs to 2027.

Headquartered in Irvine, south of Los Angeles, the firm has been busy in Brooklyn lately. Earlier this year the company paid $315 million to buy two multifamily buildings at Pacific Park from Greenland USA.

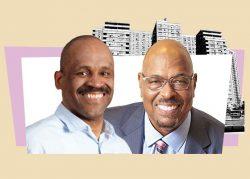

The private investment firm, headed by CEO Daryl Carter, teamed up in 2020 with another Black-owned firm, San Francisco-based MacFarlane Partners, to launch Aspire Real Estate Investors, which they billed as the first publicly traded REIT to focus on affordable and workforce multifamily housing.

Aspire withdrew its $300 million IPO later that year, citing market conditions.