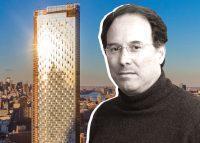

Extell Development reached two agreements to refinance portions of its One Manhattan Square condo development.

The developer landed loans of $217 million from Bank of America and $49 million from Athene Annuity and Life Company for its Two Bridges residential tower, according to public records.

The larger loan covers 242 unsold condo units and a garage unit. The smaller one is secured by 113 unsold condo units. Together, that’s 44 percent of the apartments in the 847-foot luxury development.

The refinancings retired debt previously provided by Forethought Life Insurance Company. A mortgage severance agreement noted the retirement of $189 million in debt.

Extell did not immediately respond to a request for comment.

Read more

It’s not clear why Extell decided to refinance the unsold units now, but it’s possible the previous debt was set to come due soon. Interest rates have risen considerably in recent months as the Federal Reserve has acted to tame inflation, so Extell may be stuck with higher interest rates than it could have gotten early this year — and higher than on the loan it replaced.

In 2019, Extell landed a $690 million refinancing package for the entire 80-story, 815-unit Two Bridges condo tower. Blackstone was the lender on that deal, which was divided between a $553 million senior inventory loan and $138 million mezzanine loan.

A majority of that loan went toward retiring a $750 million construction loan provided in 2016 by a consortium led by Deutsche Bank, Bank of China and Natixis.

Sales at One Manhattan Square have a long way to go, although the project’s website calls it the “Manhattan’s best-selling waterfront condominium.” Marketproof data recently reported by Bloomberg revealed only 57 percent of units have sold.

Gary Barnett’s firm has attempted to soothe buyers’ concerns about borrowing costs by offering a “Rate Rewind” program at both One Manhattan Square and Brooklyn Point in Downtown Brooklyn. Under the program, the sponsor buys down mortgage interest rates by 2 percentage points during the first three years of the mortgage.