Manhattan’s investment sales market was poised for a dramatic comeback last year until high interest rates and other economic headwinds ushered in a slowdown that began over the summer and will likely persist deep into 2023.

Transactions for commercial properties last year totaled almost $21 billion across 419 deals, the highest number of investment sales in the borough since 2016, according to a report by Ariel Property Advisors. That $21 billion in dollar volume represented a 40 percent increase from $14.9 billion the year before, even though the number of transactions rose by just 14 percent.

But as inflation persisted and interest rates rose, the market cooled significantly during the second half of the year. Transactions fell 25 percent, while dollar volume dropped 29 percent from close to $12 billion in the first half to a little more than $8 billion in the second.

Those issues aren’t going away: Dollar volume is expected to drop this year, though some in the industry predict that transactions may increase as sellers with maturing loans look to unload properties.

Multifamily properties were particularly in demand last year, accounting for 58 percent of deals and 38 percent of dollar volume, both the most of any one asset class. The 244 transactions for multifamily properties totaled $7.9 billion, more than doubling 2021’s figures for the highest volume recorded since 2016.

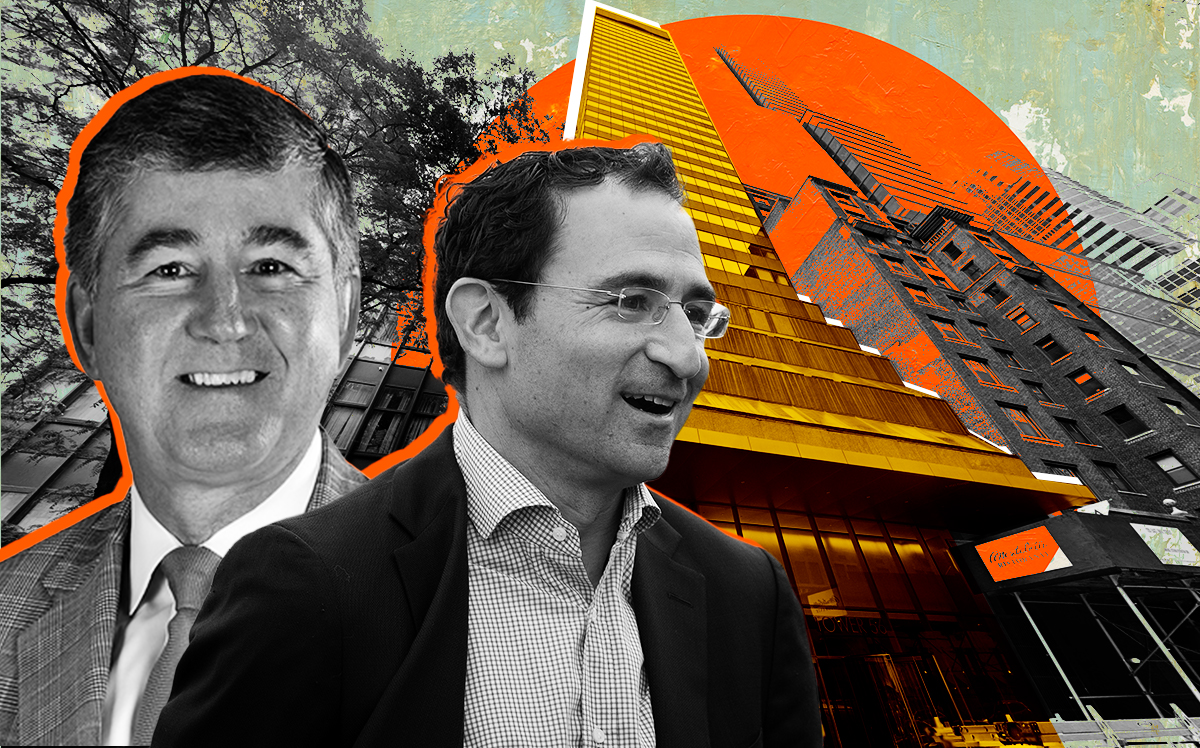

Ariel’s Michael Tortorici said the performance “underscores both the market’s appetite for cash-flowing assets and its long term faith in Manhattan multifamily investments.”

The median rent for a Manhattan apartment peaked at a record $4,150 per month in July and ended the year down only slightly from that mark at $4,048, according to reports by appraiser Miller Samuel, while the vacancy rate returned below its 10-year average after spiking earlier in the pandemic.

The office market also saw dollar volume increase, from $4.8 billion in 2021 to $7.4 billion last year, although SL Green Realty’s $1.8-billion acquisition of 245 Park Avenue in September accounted for about a quarter of that. Still, deals for office properties jumped 63 percent year-over-year.

Read more

Deals for other commercial properties, including hotels and retail buildings, skyrocketed 95 percent while dollar volume rose 63 percent to $2.5 billion. But the average price per square foot declined by 52 percent as shuttered hotels sold for discounts.

Development sites saw close to $2.7 billion in dollar volume across 38 deals last year, relatively flat year-over-year after taking out Extell Development’s $931 million megadeal for the former ABC television studio campus on the Upper West Side. The average price per buildable square foot dropped 11 percent and was down 41 percent from pre-pandemic levels, which Ariel suggested was due to the expiration of the 421a property tax break for multifamily projects and rising interest rates.