A Tribeca office property for which Nathan Berman’s Metro Loft is in contract is being marketed again and could go to another buyer.

A spokesperson for Metro Loft said in January that the firm had yet to close on the Calicchio family’s 56 North Moore Street but expected to seal the deal in the next few months.

But this week, brokerage Avison Young listed the building for sale, touting its redevelopment potential as a corporate headquarters or boutique office. Metro Loft had been eyeing a conversion to residential use.

The listing might signal that Metro Loft has pulled out, a commercial broker unaffiliated with Avison Young told The Real Deal. But a spokesperson for Metro Loft said the firm is still in contract to buy the building and a residential project is still on the table.

The spokesperson said Avison Young told the firm that unless Metro Loft could show “materials for the sale,” the brokerage would need to explore other options.

An Avison Young spokesperson said the brokerage is marketing future office space at the site to prospective tenants, but would also entertain a sale to a tech firm, such as Google or Samsung. Meanwhile, Serhant is looking for a buyer that would convert the property into luxury residential, the spokesperson said.

“If someone wants to buy it, they can certainly buy it,” the spokesperson said, noting Metro Loft now expects the deal to close this summer.

Still, the unaffiliated broker, who requested anonymity, said a buyer still in contract would likely file a lis pendens on the property to secure the sale.

The document, filed in conjunction with a lawsuit concerning the property’s title, would make it difficult for the owner to sell the site to another party, according to the law firm Bergstein & Ullrich.

Legal records show no evidence of a suit involving the owners of 56 North Moore.

If the deal has fallen through, the higher cost of financing may be to blame.

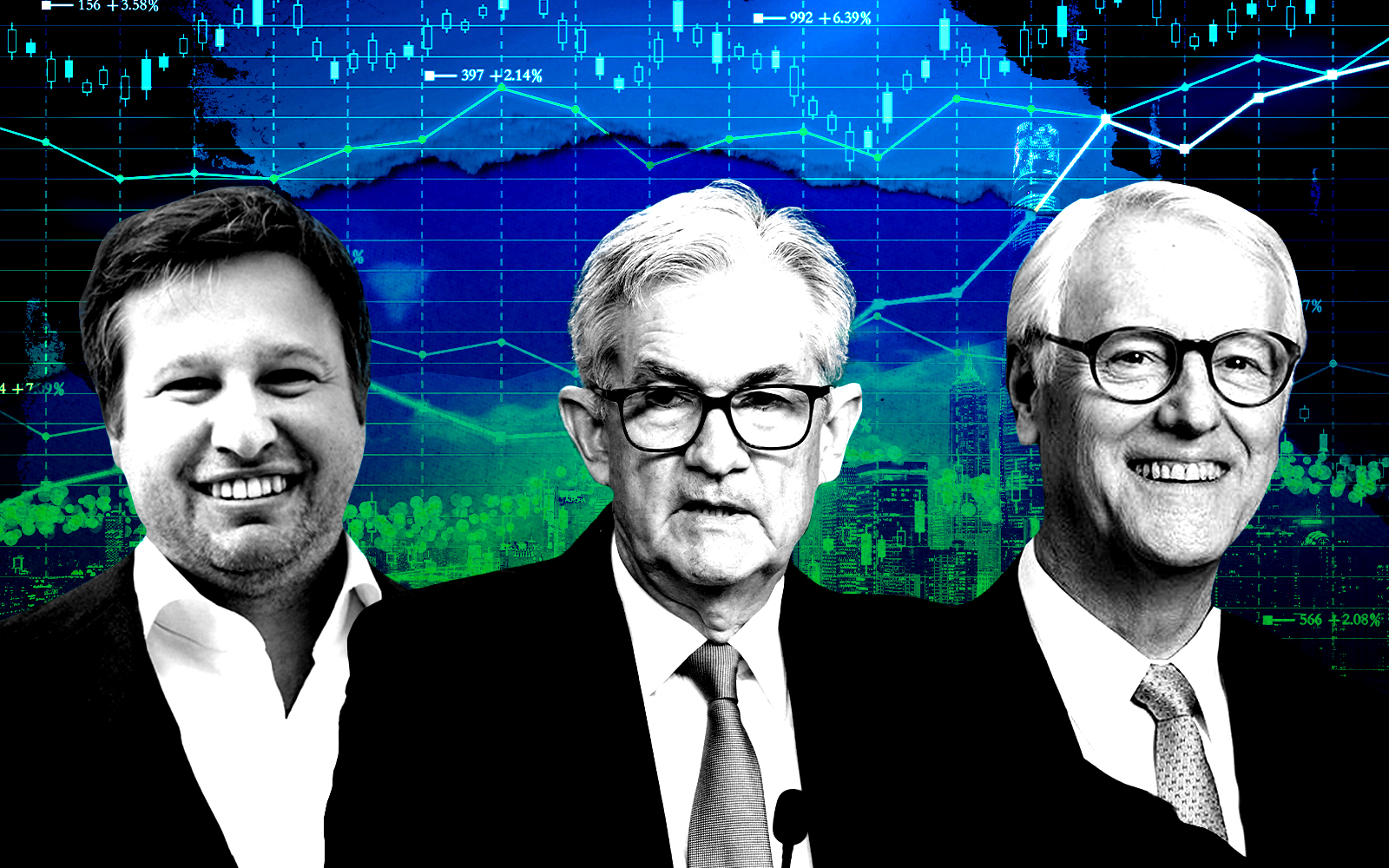

In the past year, the Federal Reserve has hiked the federal funds rate 4.5 percentage points, driving the cost of debt higher and creating a bid-ask gap that has slowed investment sales.

In Manhattan, the volume of commercial real estate deals dropped about 25 percent in the second half of 2022 compared with the first, according to an Ariel Property Advisors report.

This week, Fed Chair Jerome Powell signaled a more aggressive approach to fighting inflation, which could come in the form of a 50-basis-point rate hike later this month. Such an increase would be the highest since December.

That trajectory signals that rate hikes may continue into the second quarter, CNN reported, which could complicate Metro Loft’s plans to close on 56 North Moore this summer. Gov. Kathy Hochul has proposed a 19-year tax incentive for office-to-resi conversions, but its fate in the state legislature is uncertain.

This is not the first time Metro Loft has labored to close a deal in recent months.

Last fall, the firm, alongside Silverstein Properties, pushed the closing date on its office-to-resi conversion play at 55 Broad Street from October to the first quarter of 2023.

“Given the current interest rate environment and general economic forecasts, all debt and equity raises are much more challenging today than they would have been six to eight months ago,” Berman told The Real Deal at the time.

Read more