It’s the economy, stupid.

That mantra, which helped former President Bill Clinton win the presidency in 1992, underscores how important a strong economy is to people’s livelihoods.

Unless you’re a real estate broker in New York City right now.

In that case, you may be hoping for signs of a weakening economy. That’s because a resilient economy encourages the Federal Reserve to keep raising interest rates in its quest to push inflation down to 2 percent. High interest rates depress the real estate market.

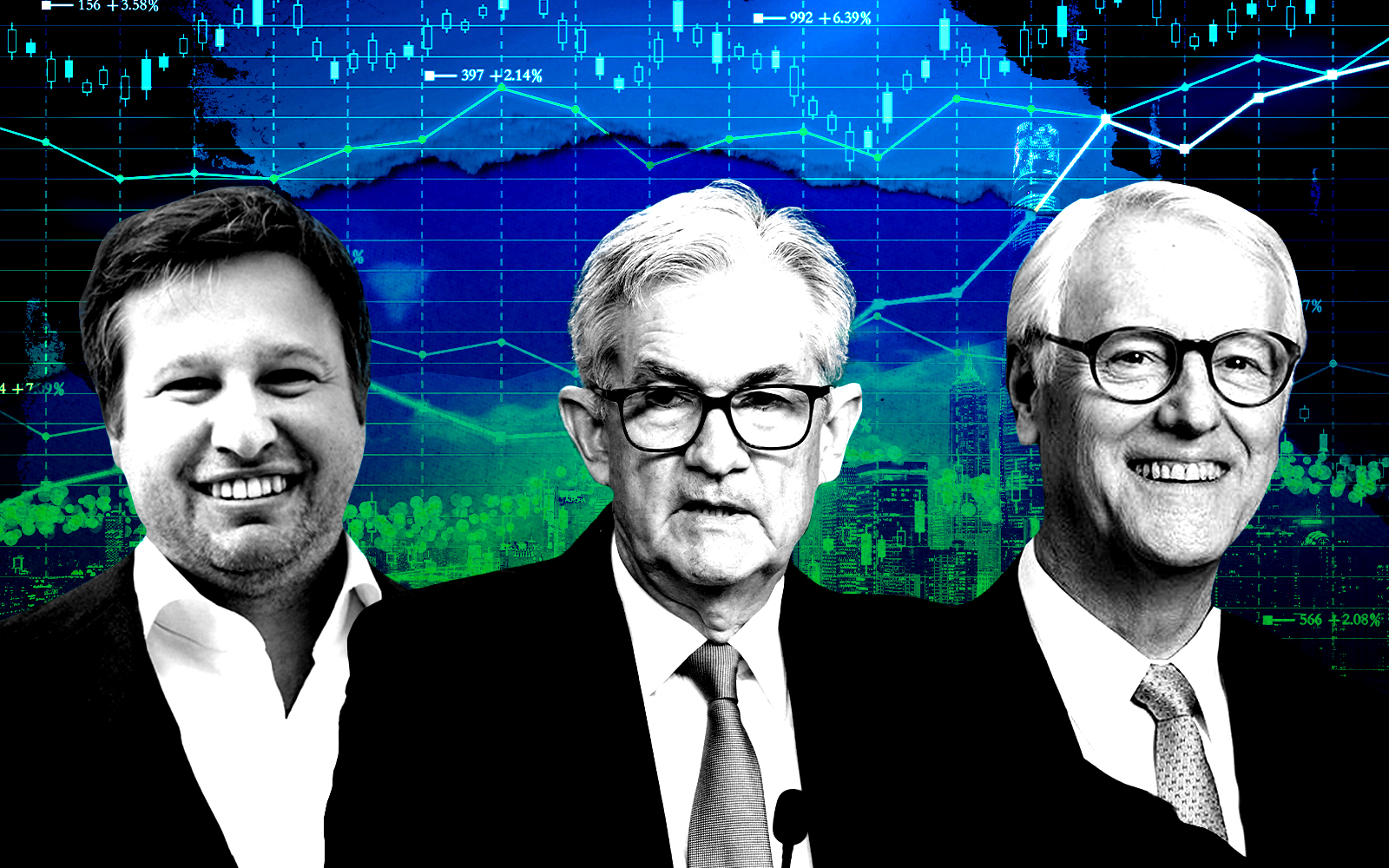

Strong economic indicators — like a stronger than expected jobs report last month — caused Federal Reserve Chairman Jerome Powell to say on Tuesday that the central bank might push interest rates up faster and higher than previously expected. That can pull mortgage rates up, discouraging people from buying and listing homes.

Until recently the consensus among brokerage executives and star agents was that a strong market would emerge in the second half of 2023, after a painfully slow fall and winter. Though brokers say activity is returning to the market, Powell’s recent statements have cast doubt on that rosy forecast.

“We’re finally starting to see the light at the end of the tunnel and the Fed is ruining all of that for us,” said Jessica Peters, a Douglas Elliman broker. “We’ve had it really tough for the last six months across the board. …Unless interest rates mean nothing to you, it’s really severely affected the market.”

Buyers aren’t getting the discounts they expect in a slow market, Peters said, especially in new developments, where the high cost of labor and inflation is keeping developers from slashing prices. And while buyers are showing interest, they want to be blown away by a home before making an offer.

“The buyers are there, they’re just very picky,” she said. “People don’t even want to buy a dirty apartment these days. They don’t want to buy in a building without a finished roof deck.”

Jeremy Kamm, a Coldwell Banker Warburg broker, said that the market for studios and one-bedrooms remains challenged, and that buyers are moving away from buildings with high monthly charges. He’s also seeing more all-cash deals.

“In the last eight or so months I believe every single deal north of $2 million has been a cash deal,” he said, referring to a sample of about 10 deals.

Kamm recalled a buyer who went into contract planning to finance 60 percent of the $3 million purchase, only to buy the home outright.

“When she ran the numbers and saw what she’d be paying [in interest], even though stocks are challenged, it just made more sense to liquidate,” he said. “She could still entertain taking out a mortgage on the home two years from now [if rates fall].”

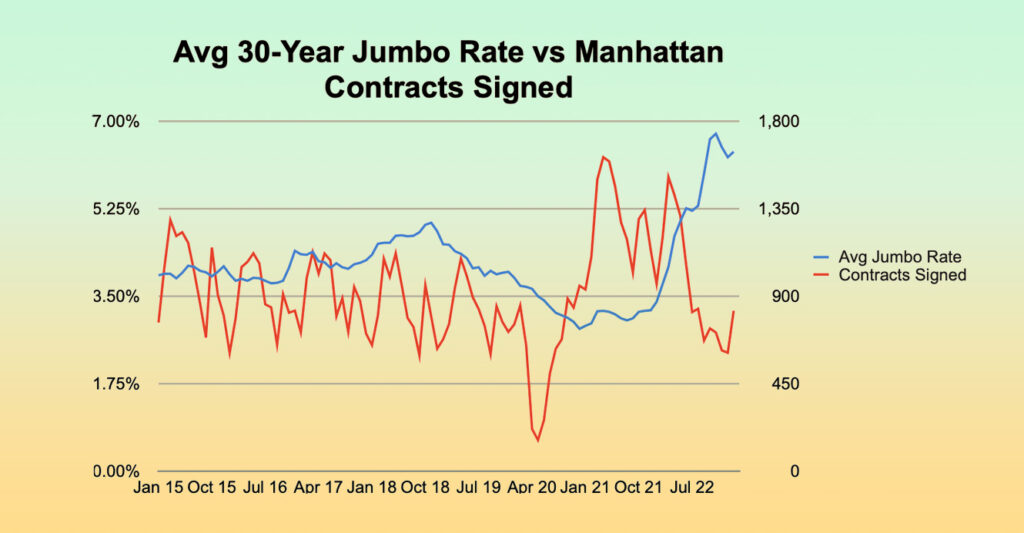

Such examples cause UrbanDigs co-founder John Walkup to doubt the impact of mortgage rates on the city’s real estate market, especially in Manhattan. His real estate data firm has been tracking the relationship between mortgage rates and signed contracts.

“You’d think there’s a natural relationship between the two,” he said. “There is a relationship, but it’s pretty weak, to be honest.”

To that effect, Bianda D’Alessio, a broker with Nest Seekers, said business has been strong for her. “This has been one of the best first quarters I have seen in my entire career,” she said.

This morning’s national jobs report will help determine how aggressive the Fed will be when it meets this month, according to Melissa Cohn, a senior executive at William Raveis Mortgage.

“We were looking for no one to have gotten a job in the month of February,” said Cohn, exaggerating for effect. “If we see those good numbers, I think we’ll see rates really start to settle back down — and the New York market likes lower interest rates.”

Cohn said investors were expecting the report to show 225,000 jobs created in February. Anything above that will have a negative impact on rates.

Substantially lower job creation, however, could lead to moderate rates that catalyze the city’s real estate market, though Cohn noted the Fed also considers other indications, such as the Producer Price Index and the Consumer Price Index.

“If we got 150,000 new jobs created, the market would cheer,” she said. “We’d have a big day on Wall Street.”

It didn’t happen: The Bureau of Labor Statistics reported Friday morning that 311,000 jobs were added. That was tempered by the news that wage growth was lower than expected.

Read more