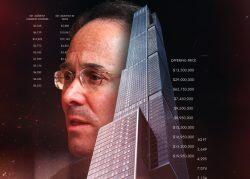

Extell Development got a $500 million condo inventory loan from JP Morgan Chase, secured by apartments at Central Park Tower, according to publicly available documents.

The bank, which is also the construction lender on the project, structured the funds as a mezzanine loan, according to the lending document. Such loans are not usually secured by real estate but by ownership interests in a development.

But in this case, the collateral for the loan is 87 apartments at the luxury building, representing about half of its inventory — all unsold when the loan was made.

The project’s original $380 million mezzanine loan, provided by Sail Harbor Capital and Boston-based hedge fund Baupost Group, carried an interest rate of 14 percent and was scheduled to mature in June at the latest.

The financing has received little attention to date, perhaps because it was erroneously recorded as being only $5 million. An Extell executive signed for the loan in late January. The company did not return a request for comment.

Sales on 81 of the building’s 179 units have closed, according to Marketproof, with two more in contract — one of which was asking $63.5 million. The building, at 217 West 57th Street, has generated revenue of $1.6 billion, about 40 percent of its forecasted $4.1 billion sellout price, although Extell CEO Gary Barnett admitted last summer that that target was too ambitious.

Barnett has been selling units at a healthy discount to their 2017 offering-plan prices since at least the fall of 2021.

Baupost declined to comment on whether its mezzanine position was retired by JP Morgan’s larger loan. Sail Harbor could not be reached.

As rising mortgage rates have slowed home sales, prices for luxury real estate have softened in Manhattan. The trend has led to more demand for condo inventory loans, according to Seth Weissman, founder of private equity lender Urban Standard Capital.

“Due to slower condo inventory absorption caused by volatile market conditions, developers expecting to carry projects longer are generally looking for more runway,” said Weissman.

Unlike senior loans, mezzanine loans do not trigger mortgage recording tax, a loophole which legislators have tried to close, but which real estate interests have fought to preserve.

Read more