Empire Capital Holdings is making another move on the acquisition front, agreeing to buy a Midtown office building from Silverstein Properties.

Empire Capital is in contract to buy the property at 529 Fifth Avenue for $105 million, the Commercial Observer reported. The deal for the property, which has 254,000 square feet of office space and 27,000 square feet of retail space, works out to roughly $400 per square foot.

Silverstein has owned the property since 1978. Prominent tenants include SDC Designs, the International Federation of Accountants and EZE Castle Integration, all of which will see their leases expire between 2027 and 2033. The office portion is 63 percent leased.

The corner retail space is occupied by Wonderland Dreams; its lease goes to January 2025, but Empire could terminate as soon as next month.

Originally built in 1958 and designed by Emery Roth & Sons, the 20-story building is located just north of Grand Central Terminal and Bryant Park.

In October 2020, Silverstein refinanced the property for $171 million, a year ahead of the departure of anchor tenant Citrin Corporation. Silverstein also recently embarked on a $20 million renovation, adding an amenity floor and a 500-square-foot terrace.

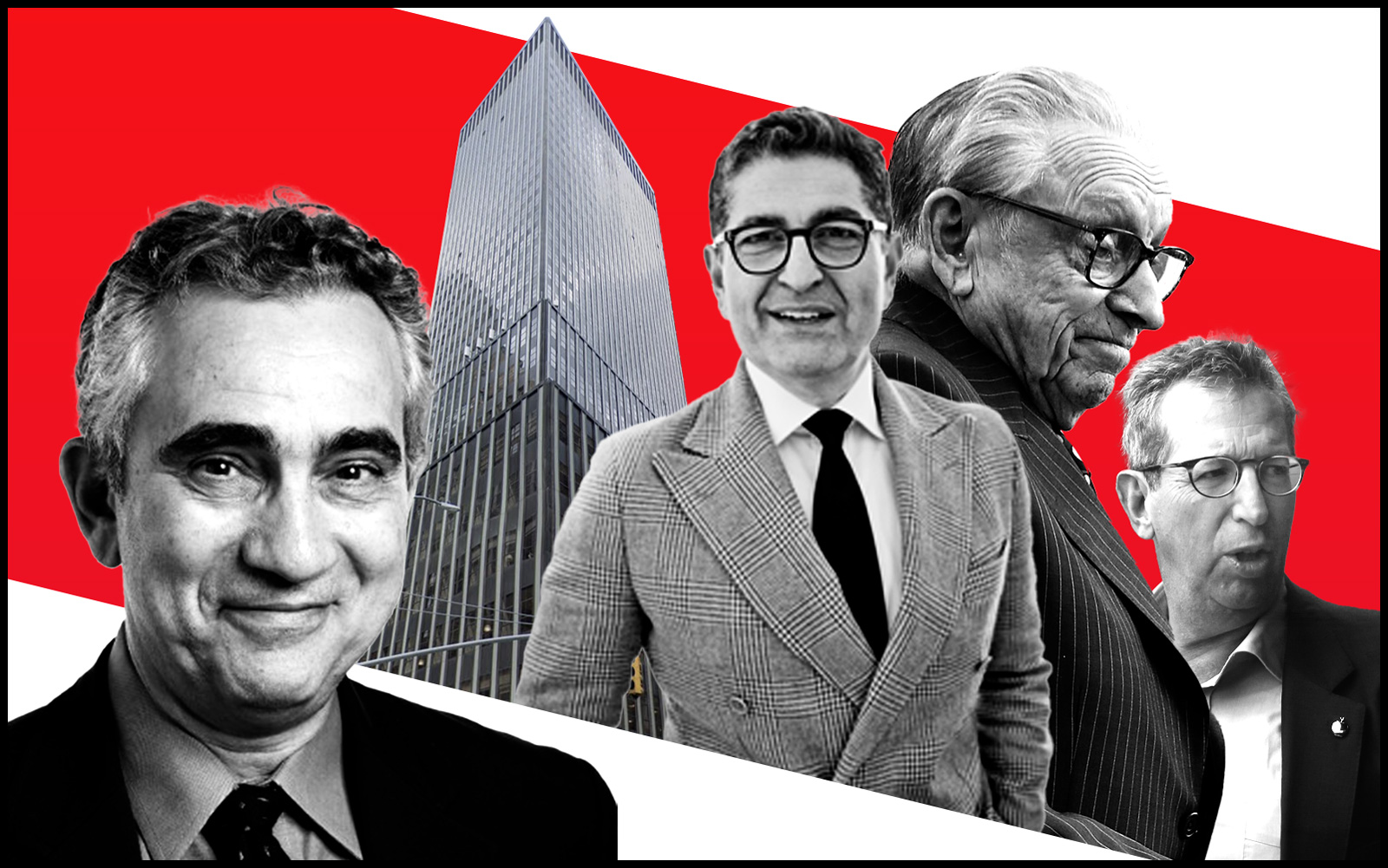

Newmark’s Adam Spies and Doug Harmon are among those who arranged the sale. Newmark’s Dustin Stolly and Jordan Roeschlaub are in the market for acquisition financing on behalf of Empire Capital.

Empire Capital, run by former commercial brokers and cousins Josh Rahmani and Ebi Khalili, emerged in recent years as contenders in the world of massive Midtown properties with a string of sizable acquisitons.

The firm in November closed on its $320 million deal for 1330 Sixth Avenue, which also included other investors such as Hakimian Capital. The purchase of the RXR and Blackstone asset was the company’s largest so far.

In 2020, the firm partnered with Igal Namdar to acquire a 25-story office building at 345 Seventh Avenue for $107 million.

Read more

Sources familiar with the firm told The Real Deal last year Rahmani and Khalili have the backing of families in their close-knit Persian community, along with institutional money.

Silverstein is in the midst of an office-to-residential conversion at 55 Broad Street with Metro Loft Management. The Financial District project is facing some resistance, though, and Solstice Residential Group recently filed a lawsuit to halt the redevelopment.

— Holden Walter-Warner