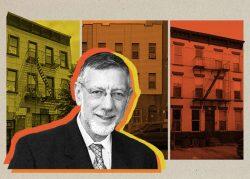

Avi Philipson finally closed his deal to buy All Year Holding’s bankrupt Brooklyn portfolio, ending a long-running saga over a sprawling collection of properties valued at nearly half a billion dollars.

Philipson’s Paragraph Partners put in $43.5 million in equity to take control of the 133-building portfolio in a court-approved deal about a week and a half ago, The Real Deal has learned. The equity represents 10 percent of the portfolio’s overall value of $435 million. It is believed that the buyer will assume substantial unsecured claims on the properties.

The on-again, off-again closing was anything but a sure thing.

Philipson and an investor group including Stephen Gorodetsky’s Whalley Capital Group and Rubin Schron’s Cammeby’s International originally agreed to buy the portfolio for $60 million last year. But when interest rates started to rise, they sought to reduce the price.

As both sides negotiated back and forth, at times it looked like the deal may fall apart. But they were eventually able to get to closing. A Meridian Investment Sales team of David Schechtman, Tamir Kazaz and Amit Doshi brokered the sale.

All Year was founded by Yoel Goldman, but was taken over by restructuring officers and put into bankruptcy in late 2021 as it faced threats of lawsuits and foreclosures. The company also sought to sell assets to pay back creditors, including Israeli bondholders.

The portfolio consists mostly of walk-up rental buildings in northern Brooklyn.

Philipson’s group separately reached a deal last year to acquire All Year’s stake in the trendy William Vale hotel in Williamsburg, but that sale fell through over the summer. All Year and Philipson ultimately reached a settlement.

Philipson, Gorodetsky, and an attorney for All Year did not return a request to comment.

Read more