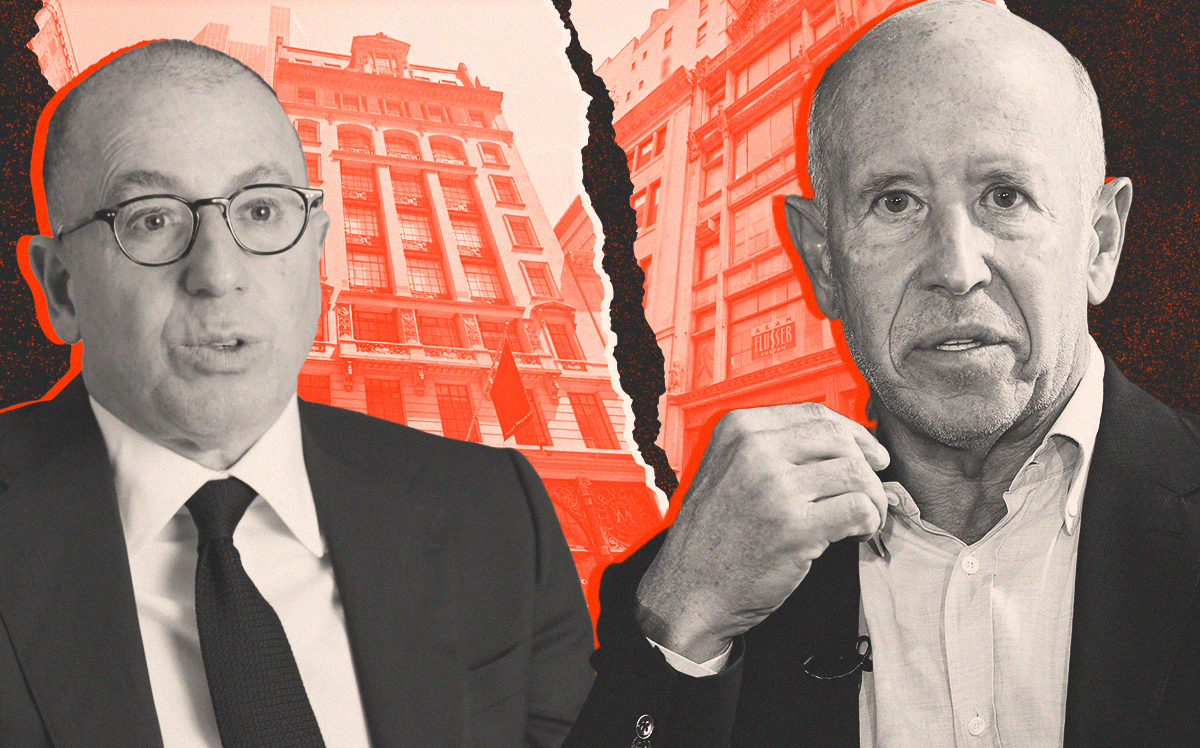

Thor Equities’ Manhattan retail portfolio is facing more distress.

A foreclosure action was filed Thursday against an entity tied to Thor, accusing Joe Sitt’s real estate firm of defaulting on a $13.3 million loan tied to 440 Broadway in Soho.

Thor allegedly failed to pay up when the CMBS loan came due in January, according to the complaint brought by U.S. Bank as a trustee for bondholders and Midland Loan Services as special servicer.

As of Monday, the firm owed the outstanding principal balance of $10.4 million, plus accrued interest at a default rate of 8.93 percent. Thor is negotiating with the lender for an extension, according to a source familiar with the filing.

Morgan Stanley provided Thor with the $13.3 million loan tied to 440 Broadway in 2012. Sitt “absolutely and unconditionally” guaranteed “prompt and unconditional” payment of the guaranteed recourse obligations of Thor, according to the complaint. The loan documents were assigned to the CMBS trust in 2013.

Thor bought the two-floor retail property in 2008 for $12 million. The building, tucked in between buildings two and three times its size on the popular retail strip, has been home to a 9,000-square-foot Foot Locker store since 2013.

The store remains open. But last July, after the sports apparel retailer failed to renew its lease within 12 months of its expiration, the loan entered into a cash management sweep period that ran through January, according to the complaint. The arrangement provides the lender control over the cash proceeds of the borrower’s operations at a mortgaged property.

All excess cash during that period, which totaled almost $375,000, was required to remain in a separate account. But the plaintiff accused the master servicer of sending some of that money to Thor in an “erroneous application” of the process.

Thor was asked to return the money, but allegedly hasn’t done so, which the special servicer says constitutes a default on the loan. Thor is also accused of failing to deliver certain reports and financial statements as required by the loan agreement.

This isn’t the first time Thor has run into trouble with its loan at 440 Broadway. The firm allegedly defaulted on it in May 2020, two months after pandemic shutdowns began, but it reached a reinstatement agreement later that year.

In the deal, Sitt agreed to make its payments on time, which would cure the default. But the January maturity date remained.

The plaintiffs are asking for the court’s permission to foreclose upon and sell the property and use the money toward the loan balance. They have also asked that a receiver be appointed to manage the property, and that Sitt be held personally liable for all payment obligations if a foreclosure sale does not satisfy the amount due.

Thor did not comment by the time of publication. Attorneys representing the plaintiff and Midland Loan, a division of PNC Bank, did not respond to requests for comment.

Read more