Trending

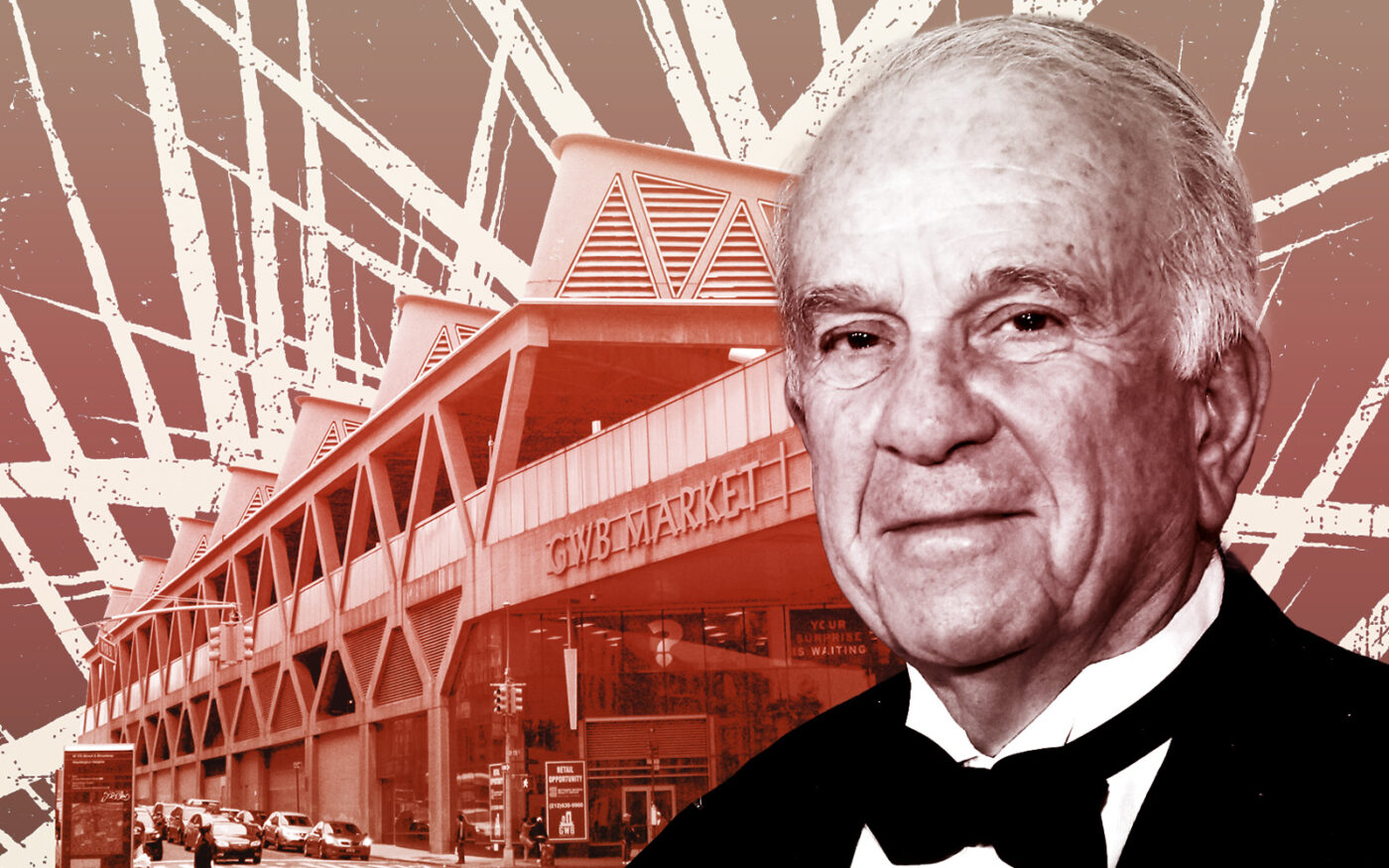

Tutor Perini suffers $83M loss on uptown retail project

Contractor unable to collect from bankrupt developer at GWB Bus Station

Another victim has crawled out of the real estate pileup at an Uptown bus terminal project.

Los Angeles-based construction behemoth Tutor Perini will declare an $83 million loss after losing a protracted legal battle at the George Washington Bridge Bus Station, a retail and transit hub in Washington Heights.

Tutor Perini was the lead contractor on the public-private project, which was completed in 2017 following years of acrimony over delays and cost overruns. The developer, an LLC that included SJM Partners and Douglas Slayton, went bankrupt, and this month the contractor’s attempt to collect hit a wall.

The publicly traded firm told investors this week that because a federal court ruled its claim on the bankrupt entity was unsecured, it will report a loss from construction operations and negative earnings per share in the first quarter.

The drama began in 2015, two years after the SJM-Slayton entity hired Tutor Perini. Each blamed the other for what became a two-year delay and $17 million budget overrun at the bus station, at 178th Street and Broadway.

The Port Authority had promised the busy terminal’s 103,000 square feet of new retail to the developer in a 99-year ground lease in exchange for its financial investment. The agency in those days was big on public-private partnerships, figuring they offloaded risk to the private sector.

But a 2016 completion deadline came and went, triggering $5,000-a-day penalties for the developer. When the station finally reopened in 2017, agency officials called the delay “an embarrassment.”

The developer filed for bankruptcy in 2019, citing delays and larger than expected costs including a four-year arbitration process with Tutor Perini. To liquidate the developer’s assets, the retail leasehold was sold for $23 million to JMB Capital. JMB later resold it for $46 million.

Tutor Perini did not fare as well, as the Second Circuit court ruled April 10 that its claim did not merit priority treatment in the bankruptcy process. For what it’s worth, the company told investors it “continues to believe that it is legally entitled to collect all or substantially all” of its costs from the renovation.

Tutor Perini and the Port Authority did not return requests for comment.