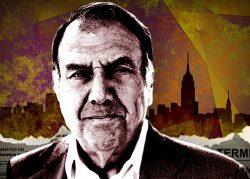

In April, Brooklyn investor and one-time “worst landlord” Zalmen Wagschal filed for bankruptcy protection on a handful of Brooklyn walkups.

The landlord chalked the bad debt up to the pandemic. Tenants had stopped paying and nearly two years of eviction moratoriums had kept Wagshal from moving them out.

But a deeper dive into the landlord’s portfolio shows Wagschal’s financial troubles predate Covid. Since 2019, he has defaulted on loans backing at least 14 properties after taking on more and more debt, a pattern that points to an overleveraged landlord who couldn’t find a way out.

The properties on which Wagschal sought bankruptcy protection — 634 Wilson Avenue, 221 Himrod Street, 867-71 Knickerbocker Avenue, 299 Throop Avenue and 1427 43rd Street — are indicative of his portfolio: six-unit walk-ups concentrated in Central and Northern Brooklyn.

The owner picked up the buildings between 2009 and 2013 for less than $1 million apiece, then borrowed aggressively against every one — more than quadrupling the debt at each building, on average.

For 867 and 871 Knickerbocker in Bushwick, for example, Wagshal paid a total $880,000 in 2012. Later that year he took out two mortgages on the properties, one for $750,000 and the other for $720,000, property records show.

In 2014, Wagschal borrowed another $3 million against the two buildings, bringing their debt to $4.5 million. In 2018, the owner got the balance reduced to $4 million, promptly borrowed another $660,500 and consolidated the mortgages — which had been acquired by Greystone — into one $4.7 million note.

If Wagschal were borrowing to finance repairs or improvements, it’s hard to see the results. In 2016 he made the public advocate’s worst landlords list for his properties’ total of 385 housing violations. Today the number at the 14 with defaults is 205.

Signs that Wagschal may have spread himself too thin began to show in 2018. After signing a contract in January to buy a vacant lot at 126 Livonia Avenue in Queens, he failed to close and defaulted on the deal, the seller alleged in a complaint.

The seller’s suit claimed Wagschal had said he “remains ready, willing and able to close title” but asked that the seller return his $27,500 deposit.

The next year, the landlord fell behind on a $2.75 million loan collateralized by 33 Nevins Street, a vacant lot in Boerum Hill. Wagschal had bought the parcel for $120,000 in 2012 with plans to construct a six-story building, city records show.

After four months of late payments, Wagschal defaulted when the loan came due Dec. 31, 2019, a complaint shows.

The next month Wagschal failed to pay off an expiring $900,000 loan he’d taken out just six months prior. The loan had financed his $1.1 million purchase of 1183 New York Avenue in East Flatbush, where permits were filed in September 2019 to build a nine-unit building. (StreetEasy now lists a number of active rentals there.)

A flurry of delinquencies followed. Since January 2020, Wagschal has defaulted on at least $30 million in debt tied to 14 properties or parcels, resulting in 11 foreclosure actions. Most are still pending.

Wagschal managed one workout, at 1183 New York Avenue. In November 2021, the lender discontinued its foreclosure suit after Wagschal sold the property for $10 to a limited liability company tied to investor Joel Lebovits, property records show.

Meanwhile, Jeffrey Fleischmann, Wagschal’s lawyer in the 33 Nevins case and a 2022 suit by Citibank claiming the landlord defaulted on a $2.7 million loan at 95 Legion Street, filed requests this year to stop representing Wagschal.

The attorney cited “a complete breakdown in the attorney-client relationship.” He did not return a request for comment.

Wagschal’s bankruptcy filing stops, for the moment, the foreclosures of 634 Wilson Avenue, 221 Himrod Street, 867-71 Knickerbocker Avenue, 299 Throop Avenue and 1427 43rd Street.

The landlord did not return a call for comment. Julie Curley, his attorney in the bankruptcy proceedings, declined to comment.

Wagschal’s bankruptcy hearing is slated for May 16.

Read more