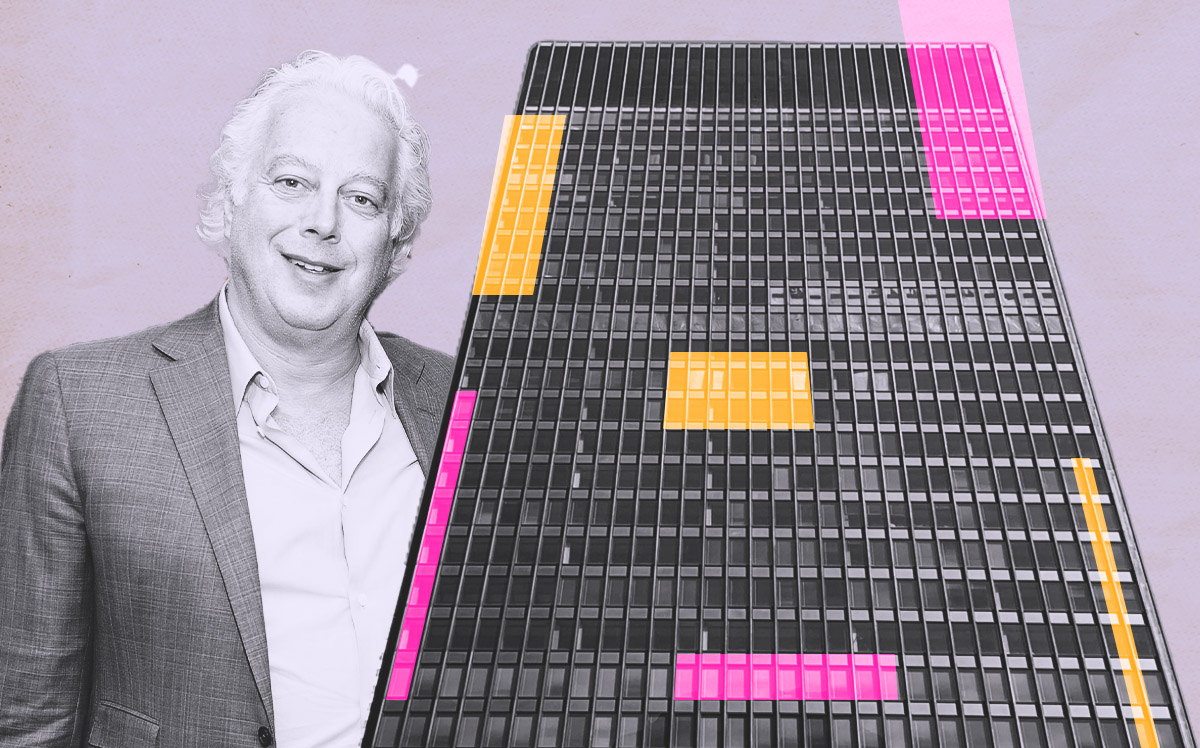

In one of the most closely watched deals of the year, Aby Rosen has negotiated an extension on his $1 billion mortgage on the Seagram Building.

The office building loan is among the largest coming due this year, and its extension carries good and bad news about the state of the financing market: Rosen’s RFR Realty wasn’t able to refinance before the loan’s maturity date, despite the building’s good health, but was able to avoid distress.

A representative for RFR declined to comment.

Details of the new deal weren’t immediately clear, though one source said it was a multi-year extension.

Representatives for Midland Loan Servicing and Wells Fargo — the master and special servicers, respectively, on the $783 million securitized portion of the debt — did not immediately respond to requests for comment.

RFR was in the market earlier this year seeking $1.1 billion to refinance the landmarked 38-story tower at 375 Park Avenue with a team at Eastdil Secured.

It was the biggest CMBS office loan maturing this year and its fate was seen as an indicator of lender appetite for office properties as interest rates rise and the sector faces challenges from hybrid work.

The Seagram Building was facing significant vacancy after tenant Wells Fargo decamped for Hudson Yards, but it has since filled most or all of that space. RFR recently pumped $25 million into renovating the 860,000-square-foot tower, including repositioning the underground parking area into a 35,000-square-foot amenity space.

The CMBS loan was scheduled to mature today, May 10. It’s not clear if RFR is still actively seeking new debt, or if the effort is now on hold.

The deal could have implications for other borrowers.

Tishman Speyer has a $485 million CMBS loan maturing in August at 300 Park Avenue. The building was 84 percent occupied as of last year. Rather than seek a refinance, Tishman had the loan transferred to special servicing so it could request an extension.

Read more