Ran Eliasaf’s Northwind Group is getting in on another major project in Manhattan, and it’s a deal that the private lender admits would normally have gone to a commercial bank.

Northwind bought the $100 million A-note on the residential conversion of the former Hudson Hotel in Midtown from private lender Parkview Financial, which had provided $207 million to the project’s sponsor last year.

CSC Coliving, a company that provides affordable housing for young residents, is converting the 878-key hotel at 358 West 58th Street into 441 apartments and more than 50,000 square feet of retail space.

“The biggest need is in the senior debt,” Eliasaf told MarketWatch. “That piece would be typically provided by a commercial bank but most are on the sidelines.”

CSC — headed by Sal and Alberto Smeke, two of Mexico’s largest multifamily owners — ground-leased the hotel from Montgomery Street Partners, which bought the property last year for $98.5 million.

Private lenders have been stepping up to fill some of the space left behind by banks — a problem that’s only grown with the regional banking crisis that brought down Silicon Valley Bank, Signature Bank and First Republic Bank.

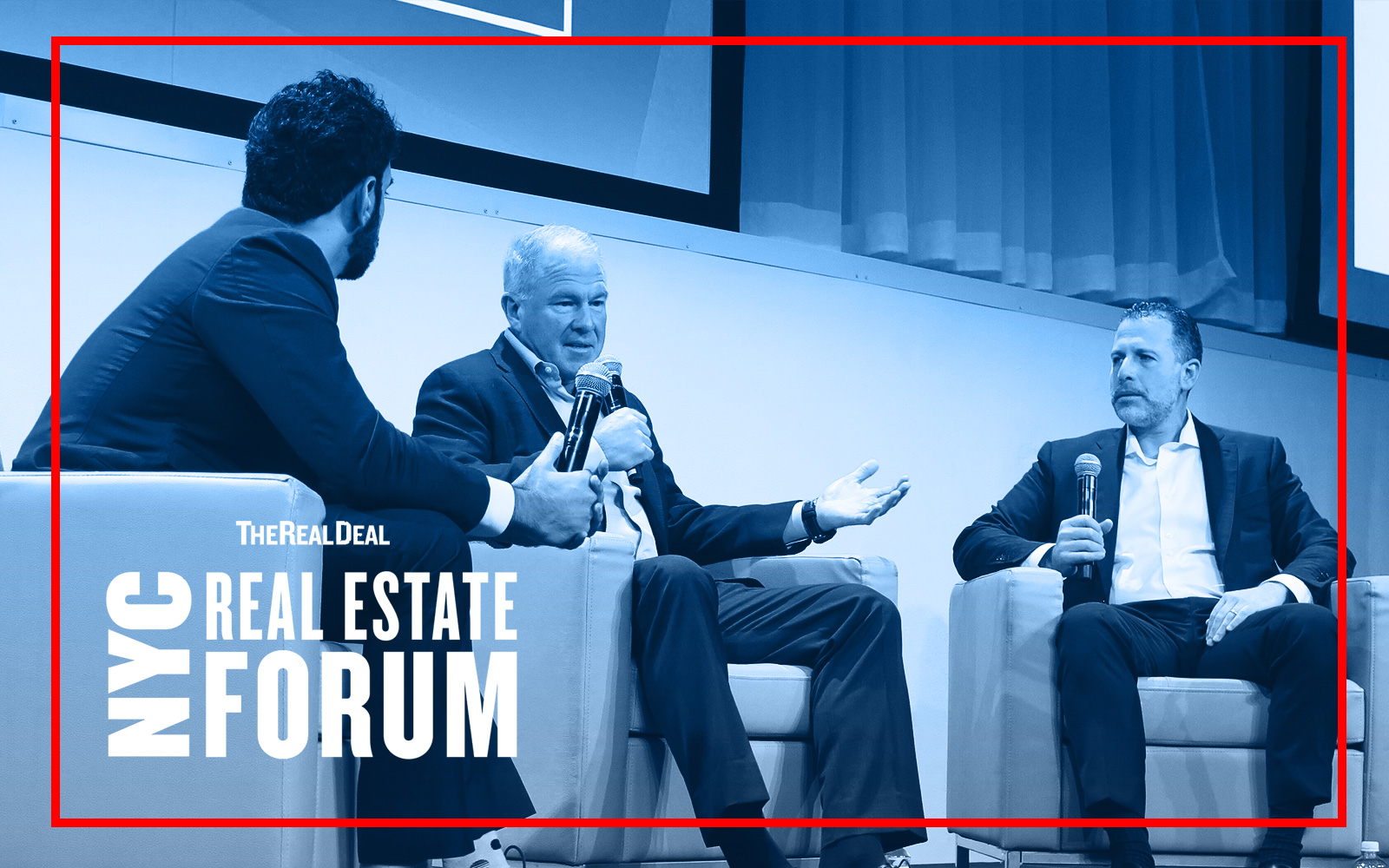

“Anytime you’ve got systemic problems in the banking sector it creates huge opportunities for guys like Josh and I,” Fortress Investment Group’s Steven Stuart said on a panel with Madison Realty Capital’s Josh Zegen at The Real Deal’s NYC Showcase + Forum earlier this month.

Zegen added, however, that private lenders cannot entirely fill the gap left by regional banks.

“There is going to be a huge void,” he said. “There is huge bifurcation in the banking system between the real big [banks] and everyone else.”

Northwind, which Eliasaf founded in 2008, has $3 billion in assets under management. The company recently picked up a $68 million loan on the former Ace Hotel on the Lower East Side from Bank Hapoalim. The Tel Aviv-based bank had decided to sell the debt after a monthslong effort to foreclose on the hotel.

In February, Northwind provided a $313 million construction loan to jumpstart Bizzi & Partners’ long-stalled supertall condo project at 125 Greenwich Street in the Financial District.

Read more