The sales market for office properties is at a virtual standstill. Yet some of New York’s biggest office owners are turning to it to raise cash.

SL Green Realty and Vornado Realty Trust are planning large-scale asset sales this year — a move others are resisting. But with their stock prices plummeting and debt costs mounting, both New York-focused REITs are under pressure to buy back shares and shore up their balance sheets.

“SL Green and Vornado both have uses for capital,” said Truist Securities REIT analyst Michael Lewis. “These two companies are going to have to be strategic and thoughtful about it.”

It’s a tough time to be selling offices. New York City office sales totaled just $470 million in the first quarter — down a stunning 85 percent from $3 billion a year ago, according to Ariel Property Advisors.

The first quarter had just one office sale. It was priced at $650 per square foot, down from an average of $865 in the fourth quarter across seven deals. In the first quarter of last year, the average price was north of $1,160.

But there are factors beyond price that influence these public companies’ decisions on whether to sell.

SL Green’s calculus

SL Green is looking to raise cash to achieve the largest single-year debt reduction in the company’s history and to buy back its stock, which is down 78 percent since the pandemic hit.

At the REIT’s institutional investor conference in December, company executives outlined a plan to sell $2.4 billion worth of properties. The largest piece is a 75 percent stake in its office tower at 245 Park Avenue. Selling the stake would remove about $1.3 billion of the property’s mortgage from SL Green’s books.

The property has a low-cost mortgage that could be passed on to a buyer — a key selling point at a time when finding affordable financing is difficult.

Other planned sales include a joint-venture interest in its new, signature skyscraper One Vanderbilt; and 750 Third Avenue, a mostly vacant, 730,000-square-foot office tower that SL Green says is a strong candidate for a full or partial residential conversion.

The REIT last month refinanced another office property nearby — 919 Third Avenue — with a $500 million loan.

CEO Marc Holliday acknowledged the tough sales environment on the company’s April earnings call, but said he believes things are improving.

“It’s still got a long way to go this year. And I think the market is coming around and I think the assets we’ve selected are the right ones,” he said.

In addition to paying down debt, the REIT is also buying back stock. The company has $122 million left under its $3.5 billion repurchase program before it must ask the board for authorization to buy more stock.

SL Green sees its stock as underpriced. Wall Street investors value the company’s shares at a rate that implies its portfolio is worth $330 per square foot. If the company can sell properties above that price, its executives believe stock buybacks would be a bargain.

Vornado’s strategy

Vornado recently shifted its tone on sales.

Acknowledging the volatile financing market, executives in February said they weren’t looking at selling assets. But the company’s stock price has fallen by half since Groundhog Day. Vornado responded by suspending its dividend for 2023 and authorizing a $200 million share buyback.

On its May earnings call, the company pivoted, saying it will look to sell a mix of retail and office assets. It declined to say which ones.

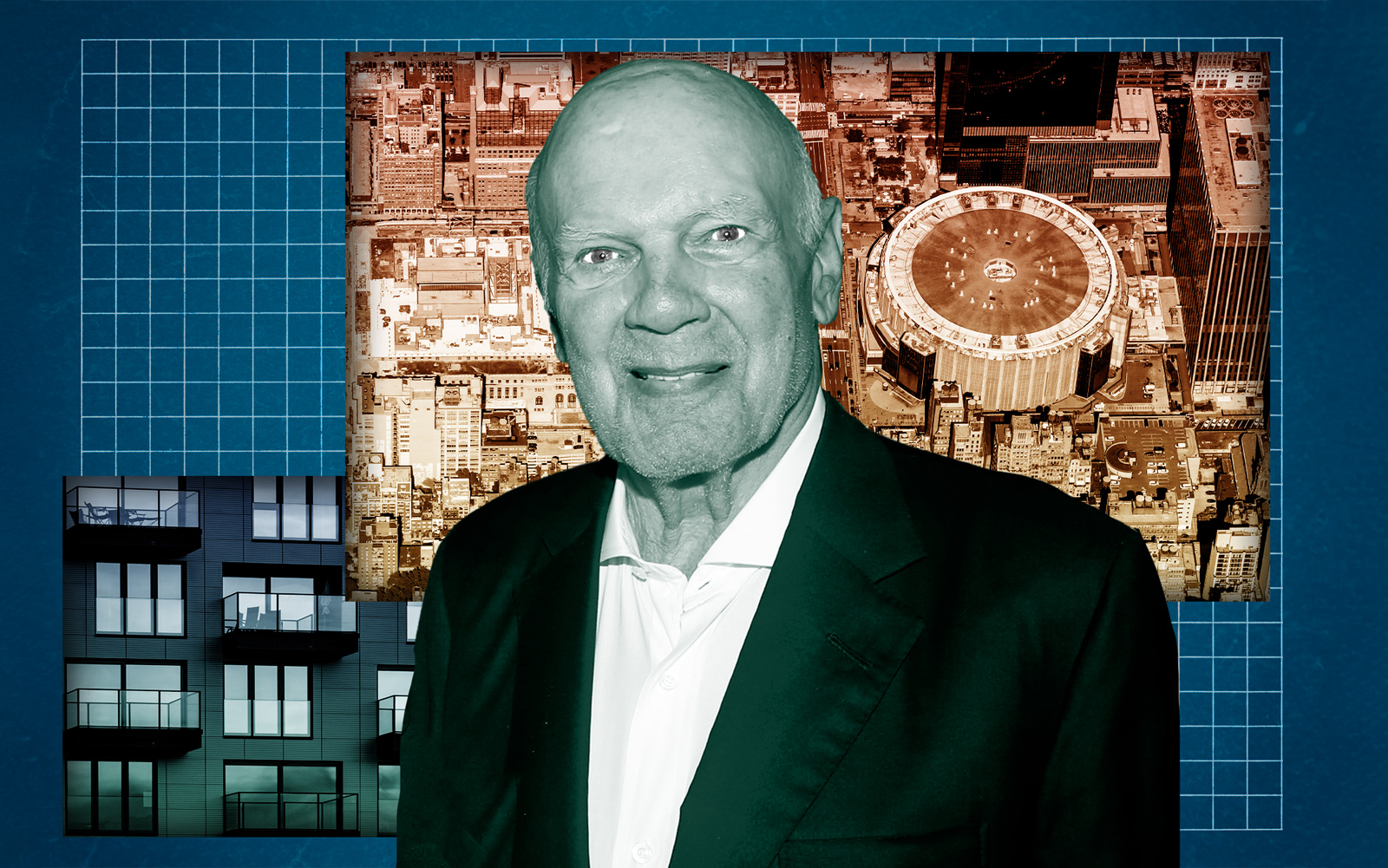

CEO Steve Roth, however, resisted the idea of being a forced seller.

“We are not a distressed seller. We are not a weak seller,” he said. “In fact, we are focusing on a very select pool of assets … where we consider ourselves to be offensive sellers.”

Vornado will use some of the proceeds of those sales to fund the share buyback program — another reversal by Roth, who had long opposed buying back the REIT’s stock. The firm’s justification is similar to SL Green’s: It says its stock is selling at a discount relative to the value of its assets.

“While the market may not be strong, or as strong as it was, and pricing has been impacted, our share price has been impacted more,” CFO Michael Franco told analysts on the call.

The company’s balance sheet could also be motivating it to sell. Goldman Sachs analysts warned this month that rising interest costs and reduced rents from tenants relocating could squeeze Vornado’s debt buffer.

The analysts said the REIT could be trending dangerously close to breaching its debt covenants, questioning whether this was putting pressure on the company to sell properties.

Read more

Representatives for Vornado and SL Green declined to comment.

Truist’s Lewis said he’s optimistic about the companies’ plans, but said they need to be clear-eyed about the market.

“Nobody should be shocked by office assets being down by 30 percent,” he said.