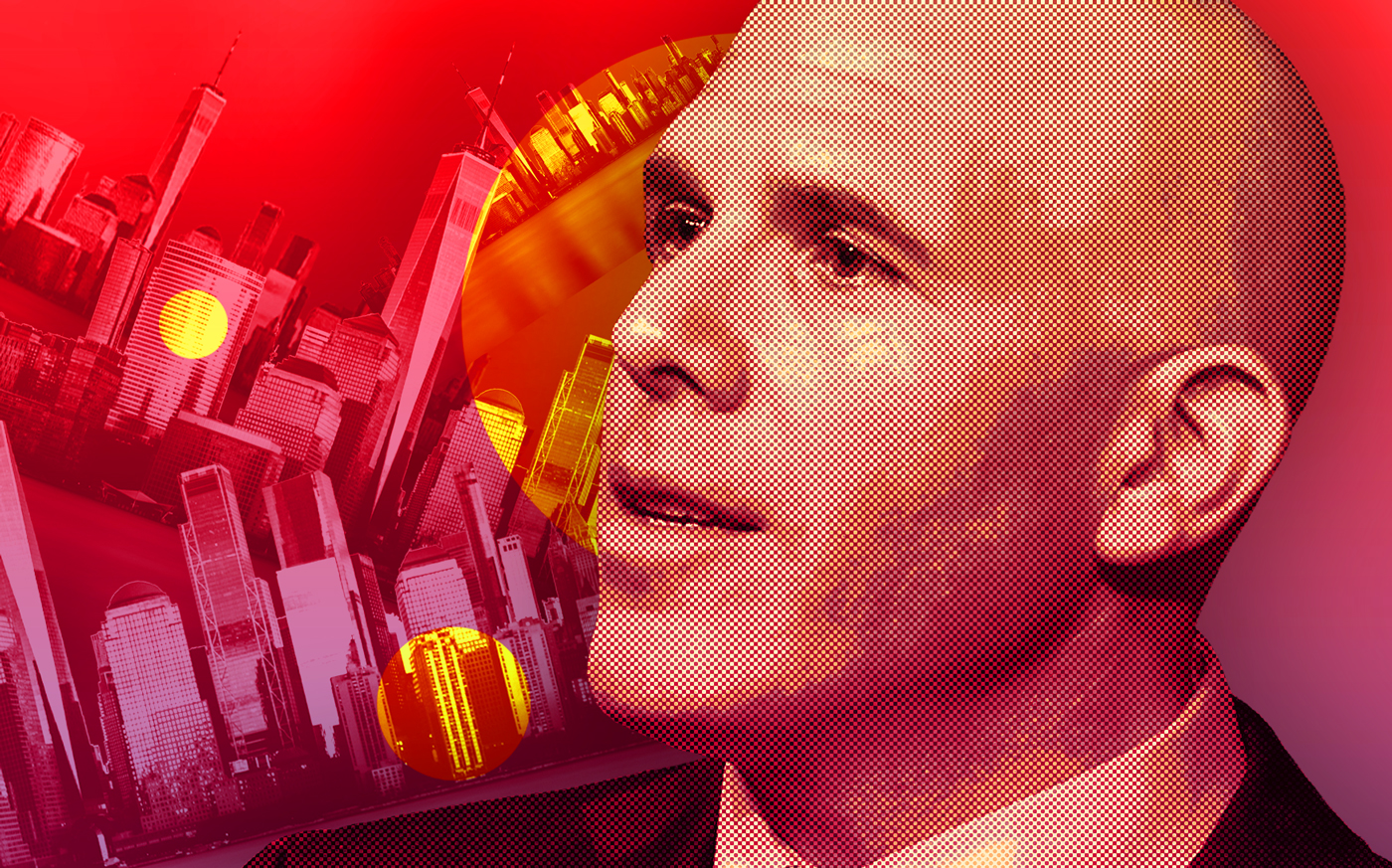

Scott Rechler’s RXR has defaulted on its 33-story office tower at 61 Broadway in the Financial District. Now the property’s lender is looking to sell the debt in what will be a big test for the city’s beleaguered office market.

RXR triggered a default when it stopped making payments on the $240 million loan in December, Real Estate Alert reported. The loan went into maturity default May 1.

The move was not a surprise. Rechler earlier this year said he was willing to hand the keys back to lenders on outdated properties that RXR can’t make competitive by further investment.

It was reported that 61 Broadway was one of those properties. Rechler told The Real Deal that he had already made back his equity on the property, in which RXR sold a 49 percent stake to China Orient Asset Management in 2016 at a valuation of $440 million.

RXR and China Orient financed the property in 2019 with $325 million in debt, including the $240 million senior mortgage from a syndicate led by Aareal Bank. If the loan trades at par, it would value the property at about $300 per square foot. That would be a 45 percent discount to the roughly $550 per square foot the 1910s-era building was valued at four years ago.

That same year, Knotel leased four floors — 60,300 square feet — at the 33-story tower. The company filed for bankruptcy two years later.

The lenders at 61 Broadway will be taking bids next month. RXR has agreed to hand the property back in July through a deed-in-lieu-of-foreclosure to help ease a sale.

It’s another crack in the office market as rising interest rates and remote work have thrown the viability of many office buildings up in the air.

In the Plaza District, L&L Holdings and its partner recently stopped making payments on the office portion of the 68-story, mixed-use Metropolitan Tower at 142 West 57th Street.

Aareal Capital Corporation — a subsidiary of Aareal Bank — is the lender on that property, and is looking to sell the defaulted note.

Read more