Vornado might not be paying dividends, but its amenities package at Penn 1 is.

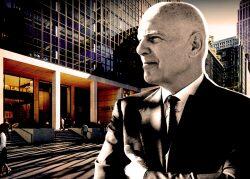

Samsung inked a deal for 36,000 square feet — the entire 26th floor — at Vornado Realty Trust’s 2.53 million square-foot office building, bringing Penn 1’s lease signings to 700,000 square feet since the REIT began renovating.

The asking rent for that portion of the 55-story tower was $100 per foot.

Samsung will move its North America ad sales group there from about 15,000 square feet at 123 West 18th Street, where the Metropolitan Pavilion holds down the base. That eight-story Chelsea loft building, built in 1917, has been owned by the Wasserstein family since the 1970s.

The new, 10-year deal at Penn 1 was negotiated for Samsung by Matt Astrachan and Simon Landmann of JLL. Vornado was represented in-house by a trio including Josh Glick and Jared Silverman.

The companies declined to comment.

Penn 1, formerly One Penn Plaza, is bounded by West 33rd and West 34th streets and Seventh and Eighth avenues, and has entrances on all four. Major tenants include Dell, Empire Heath, Gusto, Hartford Insurance, Jacobs Engineering, Morgan Stanley and Wells Fargo.

Vornado poured $450 million into the building for new plazas, curtain wall, elevators, lobbies, LEED certification and other sustainability and carbon-cutting upgrades, and to add 160,000 square feet of food and recreational amenities at the base.

The lobby has two grab-and-go options, Office Hours and Blue Bottle. A social staircase provides seating along with big LED screens that display sporting and other events. The second level has a full-service restaurant. Other selling points include a 35,000-square-foot fitness and wellness center, 20,000 square feet of conferencing space and 80,000 square feet of adaptable workspace.

Still, roughly 300,000 square feet remains available, including full and partial floors. Vornado recently suspended dividends for the year — a rarity for REITs, which must distribute 90 percent of profits to shareholders. Vornado stock, which peaked at about $96 in 2007, now trades for about $14 a share. It has dropped by nearly 80 percent since Covid struck.

Designed by Kahn and Jacobs, Penn 1 was developed in 1972 by Helmsley-Spear on land owned by Sarah Korein under a ground lease that was extended by her family to end on June 1, 2073, with an option to renew for another 25 years.

The ground lease was sold to Vornado by Helmsely-Spear’s Peter Malkin and Leona Helmsley in 1998 for $420 million, four years after Kmart leased 140,000 square feet at the bottom to open its largest store. Over time, the store, along with the entire chain, deteriorated.

Vornado bought out the rest of Kmart’s lease for $34 million in 2020 so it could complete the amenities project. Ten years earlier, the REIT installed a 6.2-megawatt cogeneration facility, halving its carbon footprint.

Read more