Real estate maverick Harry Macklowe is secretly orchestrating a deal to acquire a vacant Midtown office building where he once planned a supertall tower, according to court filings.

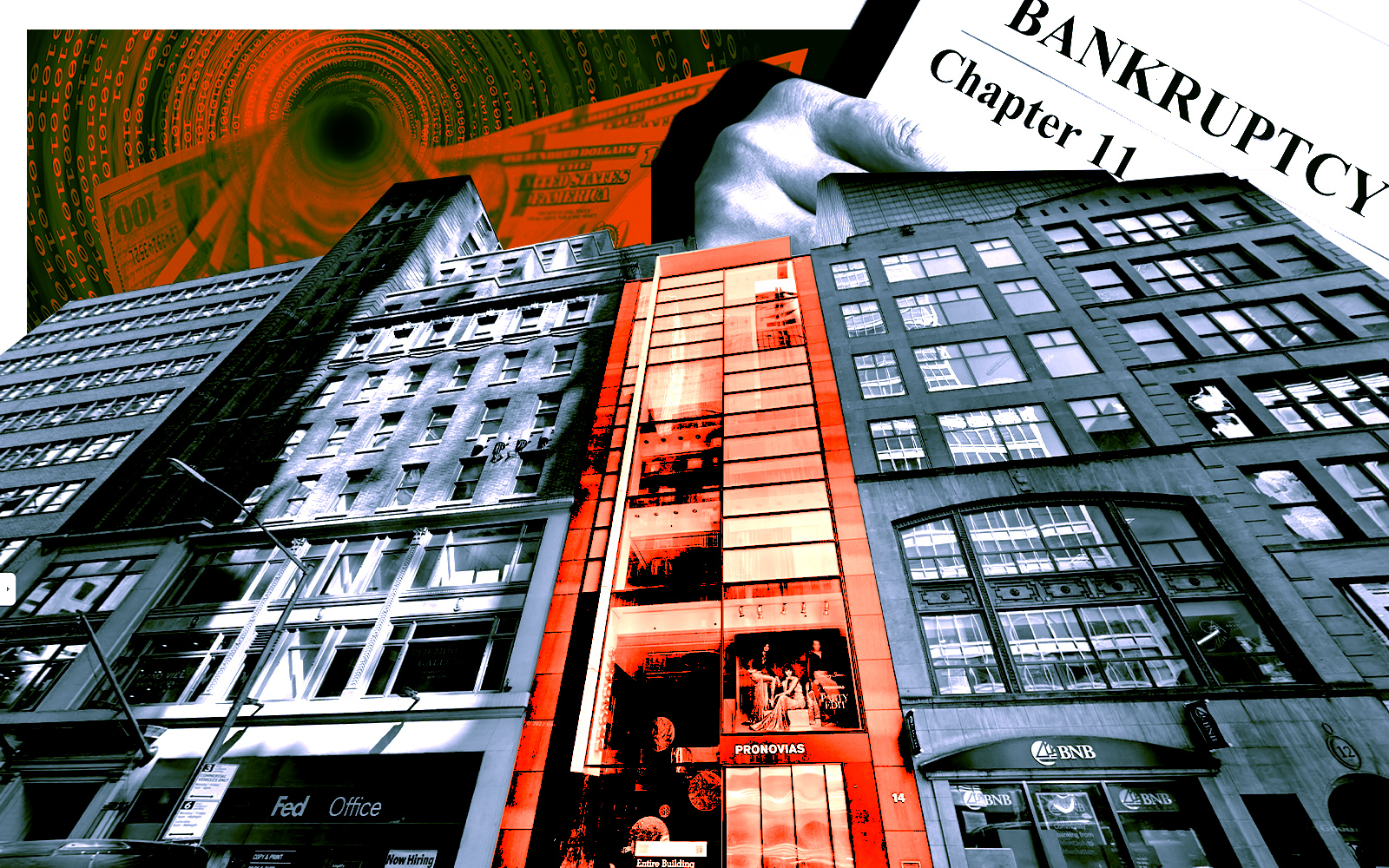

Last month, Brooklyn investor Tim Ziss put a shell company into bankruptcy as a tactic to extend the closing of the seven-story office building at 14 East 52nd Street, which the company was purportedly in contract to buy.

But according to new allegations in the bankruptcy case, it turns out Ziss was just a ringer for Macklowe.

The building’s owner, an entity tied to Spanish fashion mogul Alberto Palatchi, claims Macklowe made numerous attempts to buy the building starting in 2018, but failed after two years of delays.

Macklowe, the seller alleges, then returned to buy the building this year for a steep discount, but used Ziss to file for bankruptcy to extend the sale. The reasons behind Macklowe’s renewed effort to acquire the property aren’t clear; he did not respond to a request for comment.

The seller’s court filings detail Macklowe’s years-long quest to buy the property as part of an assemblage on which he planned a supertall office building called Tower Fifth. If he succeeded, it would have been one of New York’s tallest buildings.

Macklowe first made an offer with the seller, Inmoprisa, for 14 East 52nd Street in May 2018.

Inmoprisa agreed to sell the building to an affiliate of Macklowe Properties for $45 million, with a $4.5 million deposit. The closing was scheduled for May 2019, but was pushed back to June. To close the deal, Inmoprisa said, it terminated its lease with the building’s tenant.

Macklowe again extended the closing to August 2019, but still failed to seal the deal, leaving Inmoprisa to push back the closing to January 2020 and up the deposit to $6.75 million. Two days later, Inmoprisa agreed to yet another extension, to July 31, 2020, and increased the deposit to $9 million.

By that June, Inmoprisa was fed up with Macklowe’s delays. It gave a final notice terminating the 2018 contract and kept the deposit as damages.

But earlier this year, Macklowe returned, this time using a company called Raciv Corp to purchase the property. Inmoprisa agreed to sell the building to Raciv for $22.5 million — half the amount it had agreed to five years earlier — with a deposit of $3 million.

In April, Raciv Corp assigned and transferred the rights to the contract to 14 East 52nd Street Devco, an entity controlled by Ziss. Inmoprisa said the deadline to close was April 10.

Perhaps wary of being strung along again, Inmoprisa sought to market the property to other suitors. It was facing a major tax bill if the deal were not completed by October, the end of its fiscal year.

Inmoprisa reported capital gains of $10.3 million for the 2020 tax year because of the deposit and fees it collected from Macklowe’s first failed attempt to acquire the building. It paid taxes of $2.8 million on that gain.

Now Inmoprisa is seeking to offset that gain with the $12.23 million loss it would take on the sale of the building to Macklowe. This will only be allowed if Inmoprisa completes the deal within three years, or by Oct. 31. If the sale closes after that date, Inmoprisa will not be able to “carry back” the loss, according to its filings.

A lawyer for the Ziss entity, 14 East 52nd Street Devco, has filed its own lawsuit against an Inmoprisa affiliate, claiming a notice of default issued by the affiliate was deficient, in part because it did not provide the proper service.

But the deal is still being worked out. Ziss said in an email that he negotiated an extension with Inmoprisa to close on the property, and an attorney for Ziss’ company said the parties had agreed on the extension and an order with the court will be filed shortly.

“We look forward to working with the seller on the closing — a good partner amongst a difficult situation,” said Ziss.

Read more