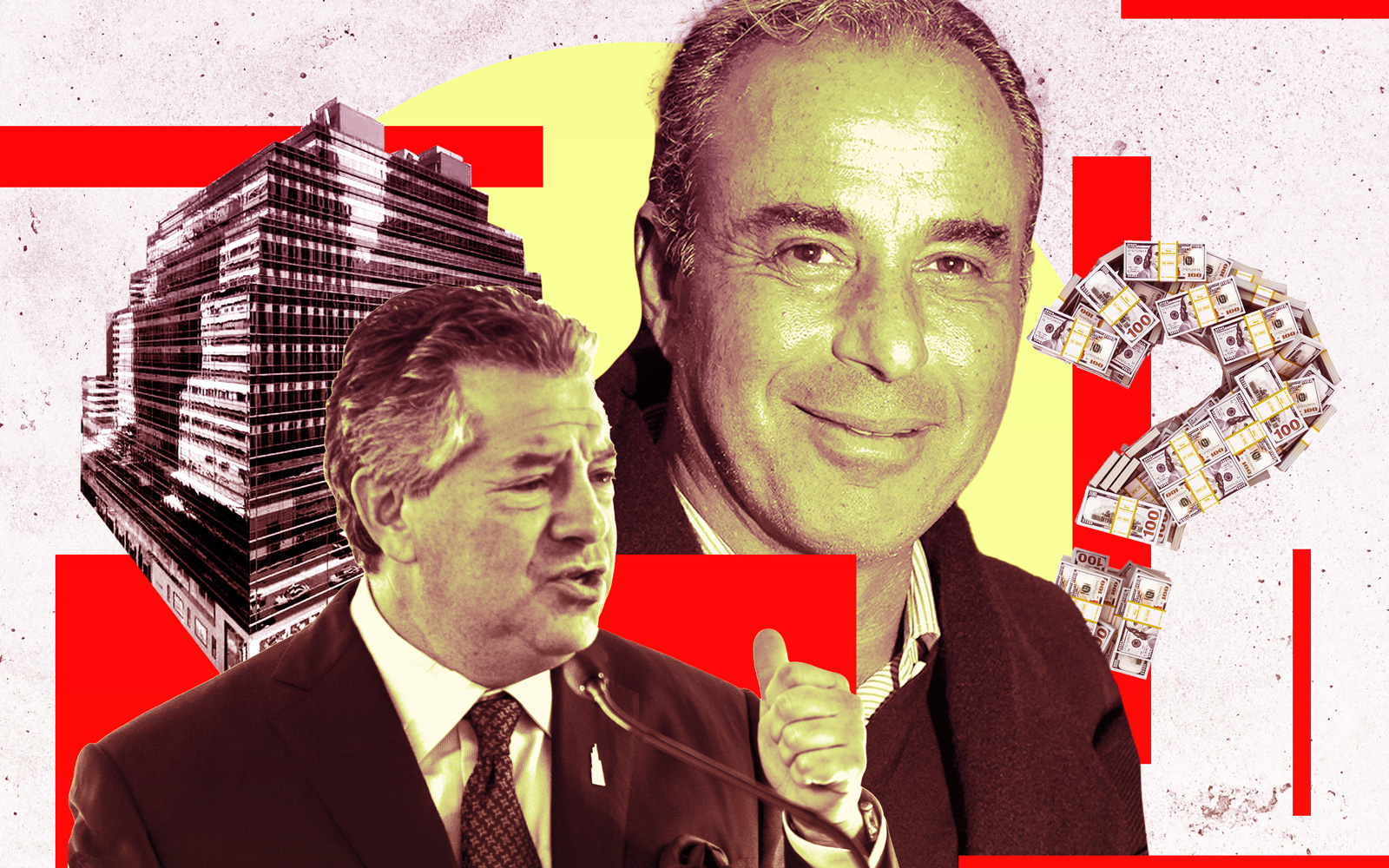

Ben Ashkenazy got his rent hike at 625 Madison Avenue. But he may not be able to enjoy it for very long.

In one of Manhattan real estate’s most ruthless ongoing feuds, SL Green is ready to foreclose on Ashekanzy’s interest in the ground underneath the Plaza District office building, which sits between East 58th and 59th Streets a block away from Central Park. The move comes after an arbitrator in April gave Ashkenazy the go-ahead to raise the rent on his ground lease with SLG from $4.6 million a year to $20.25 million.

The fate of the property now hinges on who buys the ownership stake — and for how much. Ashkenazy recently defaulted on the $195 million mezzanine loan backing his fee position. It’s not clear how much that debt has grown. (A source familiar with the property said the senior loan has accrued more than $25 million in interest.)

If no other bidder is willing to pay more than the loan’s balance, SLG could credit bid the amount it’s owed and consolidate its ownership stake.

But many view the property as a prime development site where the 1960s-era office building could be demolished and replaced with high-end residential condos. If someone saw that value and bid up the price, they would either have to find a way to boot SLG from its lease or work with the REIT to redevelop the site.

Representatives for Ashkenazy and SLG have not responded to requests for comment.

The UCC foreclosure auction is scheduled for August 8, according to marketing materials from Newmark, where a team led by Adam Spies, Doug Harmon, Adam Doneger and Dustin Stolly is handling the process.

The two sides have been on a collision course since Ashkenazy bought the lot in 2014 for $400 million. At the time, SLG’s annual rent was already considered below-market, and many believed it could be raised as high as $50 million a year — more than 10x what the firm was paying.

After an arbitrator set the rent in April, SLG called the figure “substantially above what the company believes is appropriate” in its quarterly filing, and said it would write its interest in the leasehold down to zero.

The contest for control of the property has pit two of real estate’s shrewdest strategists against one another. In 2019, as Ashkenazy was threatening his rent hike, Marc Holliday’s SLG bought a stake in his mezzanine loan from the U.K.-based Children’s Investment Fund, which still holds a piece of the debt.

The REIT’s loan-servicing arm took over in legal proceedings Children’s Fund initiated with Ashkenazy, giving Holliday & Co. a vantage point to apply pressure on their landlord as the rent dispute dragged on.

At times it’s gotten personal. In April, SLG and Children’s Fund filed a separate lawsuit against Ashkenazy, calling into question whether he maintained a net worth of $195 million as required by his loan agreement.

A judge in one of the legal proceedings issued sanctions on June 8 against Ashkenazy’s attorneys at the law firm Friedman Kaplan, saying they made misleading statements that undermined the integrity of the proceedings.

An attorney for the Friedman Kaplan lawyers say they disagree with the decision and are confident it will be reversed.

Read more