UPDATED June 12, 8:15 p.m.: Despite anxiety over higher interest rates, New York City’s new development got a new wind in May.

The spring month is typically a seasonal peak, but activity exceeded some brokers’ expectations — especially following the high mortgage rates and bank failures that plagued sales in April.

“April was one of those months that was very, very muddied by multiple factors that could have swayed things,” said Compass’ Leonard Steinberg, adding that holidays, spring breaks and the First Republic bank failure contributed to the slowdown. “Thankfully, in May, I saw an uptick.”

Though the market peaked in May — in line with previous years — some brokers say the pandemic disrupted historic patterns and has eroded some of the seasonality.

Since the pandemic, “people are just sort of living their best life, and they’re moving around,” said Douglas Elliman’s John Gomes. “It’s messing with the seasonality that we’ve become accustomed to.”

Activity largely spiked in one area: new development.

Demand for new developments has counterintuitively been boosted by higher interest rates, said Douglas Elliman’s Jessica Peters, because would-be sellers in the resale market are hesitant to list and lose their lower rates. Developers have no such issue.

New product is popping up all over the city, according to brokers, who say the backlog of new buildings caused by the lockdown part of the pandemic and a labor and material shortage is finally over.

“The ideal time to be on the market is launching sometime in March and April,” Peters said. “A lot of projects that should have been on the market 12-18 months ago are coming on the market now.”

The shift in seasonality and concerns over the state of the market in the second half of the year is a vote of confidence in projects in prime areas of Brooklyn, the Upper West Side and Upper Manhattan launching after the peak of the spring market.

“This has been the busiest Memorial Day I’ve seen in my entire career,” said NestSeekers’ Bianca D’Alessio, who launched a building in May and has two more slated for June. “We’ve expedited a lot of our launch dates so as not to lose out on the market.”

From January to May, some 26 percent more contracts were signed than during the same period from 2015 to 2019, according to data firm Marketproof.

In May, new development sales took market share from resales to rise to a post-pandemic high. New development remained a higher portion of overall sales than before the pandemic, according to Marketproof, with some would-be sellers locked in the golden handcuffs of low mortgage rates.

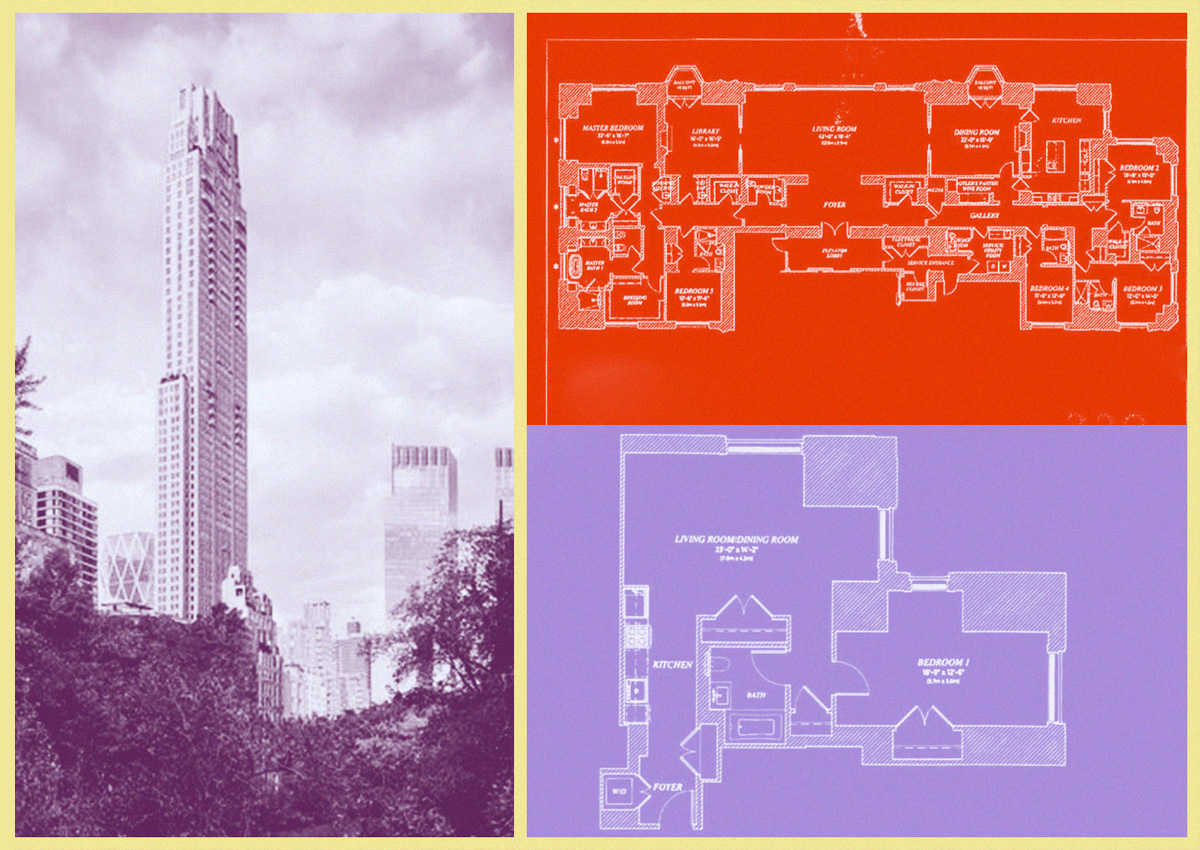

In Manhattan, Steve Witkoff’s One High Line put nine units into contract and 200 Amsterdam notched six. Brooklyn’s 110 North First rose to the borough’s top seller, with Nest Seekers’ Tamir Shemesh, Bianca D’Alessio and Christian Haag as head listing agents, and there was a sellout in Queens at 37-28 30th Street, dubbed “Novo LIC.”

But some brokers said waiting too long to launch could harm the pace of sales if the market falters in the second half of the year. In this camp is Elliman’s Frances Katzen, who recently launched a townhouse conversion on West 108th Street.

“I’m not convinced it’s the end of the world, [but] I do think it’s going to be a harder market,” she said. “This is now the real reaction to what should have happened after Covid.”

Brokers unanimously agreed the increase in supply won’t be enough to cool prices. Peters said negotiations at some developments can only go so low because of costs added by last year’s labor and material shortage.

But the overall lack of inventory could be a promising sign for the fall market, according to D’Alessio.

“It’s keeping absorption healthy and, until there’s a seismic shift, we’re not going to feel that pullback people are expecting,” she said. “I think we’re going to have a very healthy second half of the year.”

The May momentum could propel the overall market through the summer and early months of fall.

Gomes said he expects activity to remain high heading into the summer months, driven particularly by international buyers traveling to New York ready to buy after years of travel restrictions and other pressures preventing them from entering the market in the city.

As buyers continue to snap up new listings, Gomes said he also anticipates an increase in home prices.

“I predict summer will be strong,” Gomes said. “I firmly believe that, moving forward in this market that has been going up, down, up, down — and at times felt like it was going sideways — I believe that there’s going to be an upward trajectory.”

Read more

This article has been updated with broker information for the 110 North First property in Brooklyn.