Long Island City’s tallest tower will be built in short order after the developer landed a large loan for the project.

BLDG Management scored $425 million in construction financing for its development at 42-02 Orchard Street in the Queens neighborhood, the Commercial Observer reported. The planned 69-story tower is aptly named The Orchard.

M&T Bank was the leader of the financing, along with U.S. Bank and Bank of China. Other contributors to the loan included Israel Discount Bank, City National Bank and Bank Hapoalim.

A Greystone Capital Advisors team led by Drew Fletcher and Paul Fried arranged the deal.

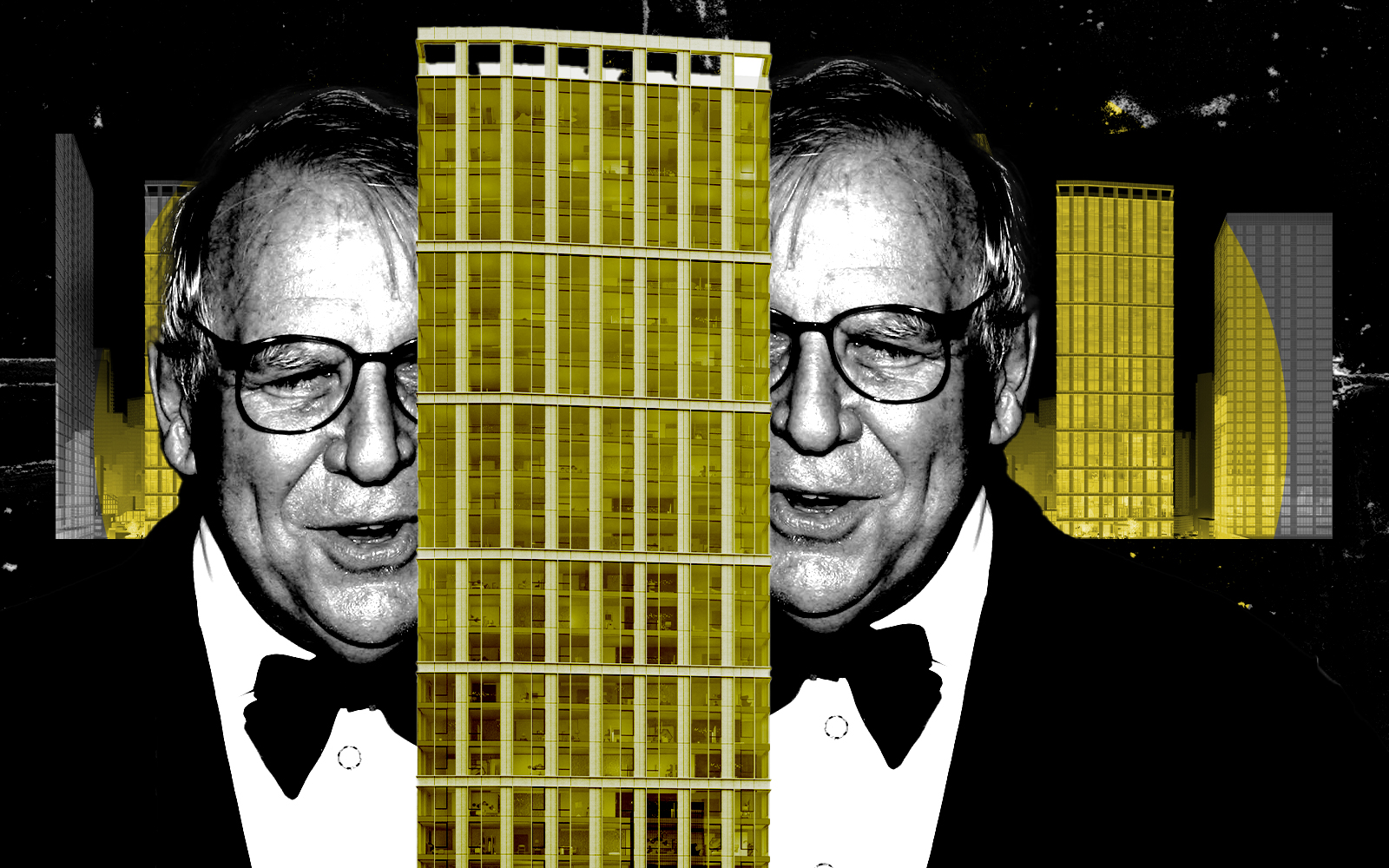

Two years ago, Lloyd Goldman’s real estate investment firm filed plans for the 800,000-square-foot project, which includes 824 units. The 780-foot tall property, designed by Perkins Eastman, will have multiple ground-floor retail spaces, more than 60 floors of residential units, swimming pools, a gym and lounges.

Critically, the project is expected to qualify for the 421a affordable housing tax break, which would make it one of the last to get in the door. The exemption requires 30 percent of units to be designated for households earning at or less than 130 percent of the area median income.

The project is expected to be completed around 2026, which is good news for the tax break’s chances of coming into play: the break requires projects to be in construction by June 15, 2026.

The Goldman family has controlled the parcel going back to 1975. At one point, it was controlled by Goldman’s father and uncle, Irving and Sol Goldman.

Other residential developments for BLDG in the city include the 41-story Summit tower at 222 East 44th Street and The Montana on the Upper West Side.

In March, Werwaiss Properties landed a $131 million construction loan for a project in Long Island City. The firm is planning a 35-story property at 23-10 42nd Road, which will include 240 apartments, a fitness center, a residents’ lounge, a sky lounge and amenity terraces.

— Holden Walter-Warner

Read more