CIM Group has decided to refinance the Dominick Hotel in Soho after exploring a sale of the 391-key property last year.

Ramsfield Hospitality Finance and funds managed by Alliance Bernstein’s CarVal alternative investment manager provided CIM with an $83 million loan for the hotel at 246 Spring Street, the lenders announced Thursday.

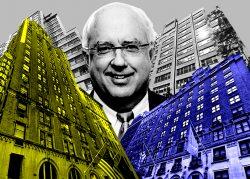

Ramsfield president Richard Mandel said the financing allows CIM, a Los Angeles-based real estate private equity firm, to keep its options open.

“All of our loans are floating rate and they provide flexibility on prepayment,” he said.

A spokesperson for CIM did not immediately respond to a request for comment.

CIM acquired the Dominick, formerly the Trump Soho Hotel Condominium, through foreclosure in 2014. The firm then rebranded the 46-story glass tower in 2017 after terminating the licensing agreement with the Trump Organization.

Headed by founders Shaul Kuba, Avi Shemesh and Richard Ressler, CIM has in recent years flirted with the idea of selling the hotel, first in 2019 and more recently in September of last year, Bloomberg reported.

Ramsfield’s Mandel said that with Disney’s 1.2 million-square-foot new headquarters set to open across the street at 4 Hudson Square next year, the hotel submarket will receive a significant boost.

The lender’s joint venture with AB CarVal has loaned more than $1 billion over the past 18 months, Mandel said, and is one of the most active hotel lenders in New York City.

Last year, Ramsfield provided a $239 million loan to Massachusetts-based investor Sonesta International Hotels to buy a portfolio of four Manhattan hotels.

Read more