Fix-and-flip? More like a fix-and-flop.

An investor in Kushner Companies’ Brooklyn Heights portfolio is now coming after the firm in a fiery complaint.

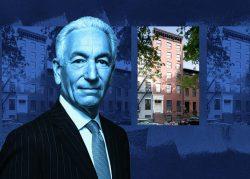

The investor, identified only as BLS Holdco LLC, filed a lawsuit Tuesday against Kushner and its CEO Laurent Morali, alleging that they mismanaged the redevelopment and kept it in the dark about the properties’ financial and legal issues.

“We are disappointed by the fact that this particular investment wasn’t as successful as expected,” a Kushner company representative told The Real Deal. Valuations were hurt by a lawsuit brought by tenant watchdog group Housing Rights Initiative, added the spokesperson, who said that BLS Holdco’s claims were without merit.

The dispute centers around six former Brooklyn Law School dorms that Kushner, a real estate investment firm founded by Charlie Kushner, acquired for $36.5 million in 2014, with plans to convert three of the properties into luxury single-family homes and rent the other three out as apartment buildings.

BLS Holdco claims it provided the project with over $10 million in equity, according to the lawsuit, which was first reported by PincusCo.

Now, nearly a decade later, BLS Holdco alleges Kushner’s “atrocious financial performance” on the townhouses reduced its investment to “a wipeout,” and that the net asset value of the three multifamily properties is now “close to zero.”

One reason for the allegedly lackluster returns on the apartment buildings was changes to state rent laws that limited landlords’ ability to raise rents on rent-stabilized units. BLS Holdco claims it was informed by Kushner that only seven of the 77 units in the three buildings were subject to rent stabilization and that the remaining 70 could be rented at market rates.

After renovating the buildings, the investor alleges, Kushner failed to re-register the units with the state Division of Housing and Community Renewal, which the plaintiff says would have allowed the units to be deregulated under the rent laws at the time.

“Instead, Kushner simply ignored all regulatory steps and treated the units … as free-market units from the start,” the complaint alleges.

In 2018, Kushner agreed to pay $100,000 to tenants in one of the buildings, 89 Hicks Street, after being sued for overcharging rents and deregulating units. In 2020, a judge granted class-action status to a lawsuit brought by tenants in the other buildings.

In this week’s complaint, BLS Holdco claimed it would not have invested in the venture had it been aware that all of the units would be rent-stabilized.

“At no time and in no manner, not even in investor disclosures of potential ‘deal risks,’ did Kushner raise the possibility that the remaining 70 units could be subject to rent stabilization,” the suit states.

Read more

As for the townhouses, BLS Holdco claims that mounting debt, cost overruns including “poor workmanship by the general contractor and poor oversight by Kushner” and their eventual sale at “fire sale” prices resulted in a net loss.

“In sum,” the complaint states, “during one of the most robust real estate cycles in recent history, Kushner lost over $13 million on the redevelopment of the townhouses.”