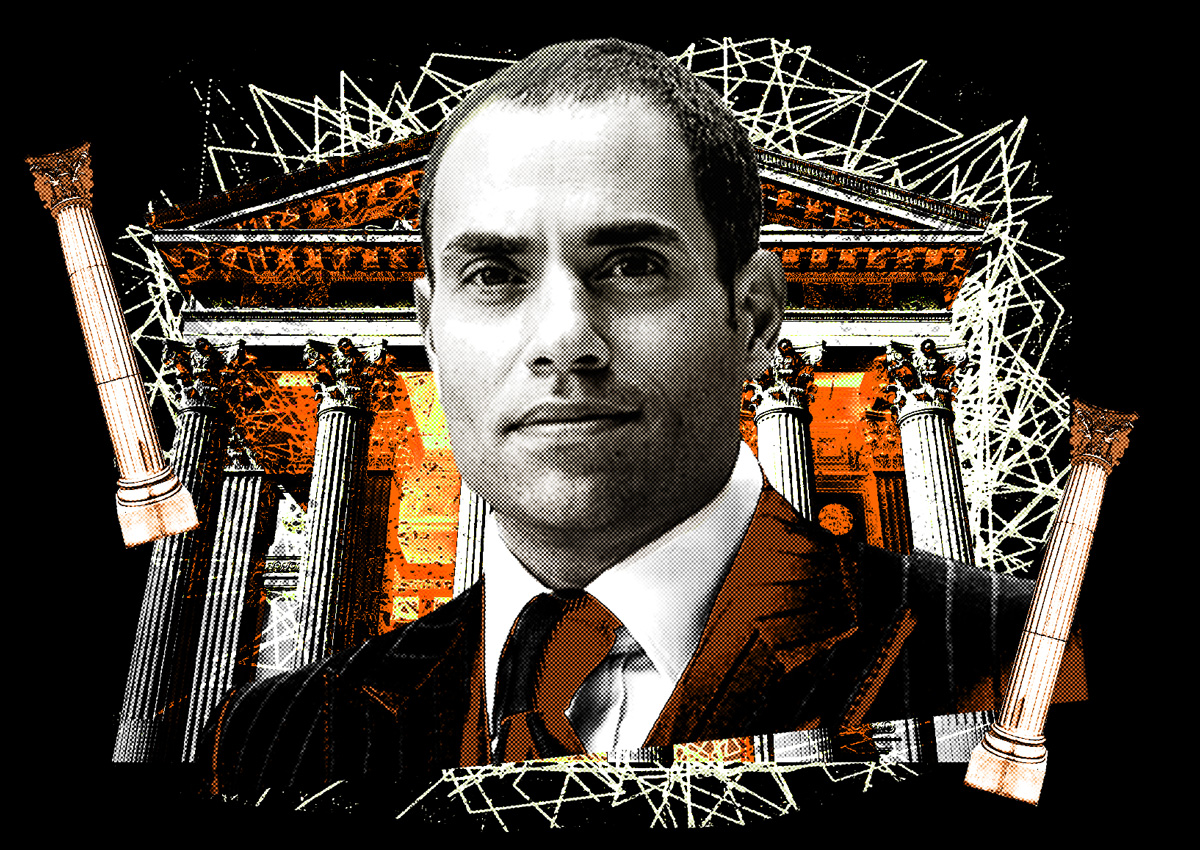

Richard Ohebshalom has lost control of a 7-story building, including an apartment where he resides, after loans fell into default at 54 Thompson Street in Soho.

Ownership of the property, which Ohebshalom pledged as collateral for $4 million in mezzanine loans, was transferred to lender SME Capital Ventures in a July auction, according to public auction notices and documents reviewed by The Real Deal.

The loss comes amid other difficulties for Ohebshalom, including other lawsuits at the Soho property and the appointment of a receiver at his 103-unit rental building in Downtown Brooklyn in May, which resulted from an earlier foreclosure action by a Chicago-based lender.

In Soho, Ohebshalom’s ownership of the 32,000-square-foot building with a mix of retail, office and residential, started when his father Fred Ohebshalom’s Empire Management bought it in 2005 for $15 million.

A year later, he bought a 2,000-square-foot apartment in the building for $1.9 million before transferring ownership to an affiliate of his own firm, Pink Stone Capital, in 2015. It was the same year Pink Stone emerged as the building’s new majority owner.

After suing his father twice in 2017 over an inheritance, Richard’s apartment became collateral for loans that culminated in a $24 million refinance by Madison Realty Capital in 2019. The amount was insufficient, however, to keep additional debt from accumulating on the building.

SME, in addition to $4 million in mezzanine loans, issued Pink Stone $4.5 million in debt beginning in 2000, records show. Madison and SME declined to comment on the property.

The only other apartment in the building, a 7,000-square-foot penthouse last purchased in 2021 for $12.3 million, is the subject of another lawsuit against Ohebshalom. The buyers, revealed in court records as Hugh and Tri Nguyen, are executives at Miami-based mortgage lender Network Capital, once called out for unscrupulous business practices by the L.A. Times.

Since buying the apartment, the Nguyens say they had received two shut-off notices from utility provider ConEd allegedly due to Ohebshalom being in arrears. They filed a lawsuit in February, just months after Ohebshalom denied their request to build a pool on the roof, and have subpoenaed financial records for the building citing $1 million in unpaid property tax.

Ownership of the penthouse did not transfer to Ohebshalom’s lenders this month, but SME will now likely inherit a different lawsuit, this one from a former commercial tenant at the building. In March, an affiliate of the Italian linens brand Society Limonta filed a lawsuit against Ohebshalom for allegedly withholding a $38,000 security deposit.

Current tenants at the building include the restaurant Pera Soho, advertising agency Ralph Creative and medical researcher Holmusk.

Until Richard lost the Soho property at auction this month, his father’s Empire Management had retained a minority ownership interest. That familial, financial relationship may have hastened the loss of the property by making it risky to declare bankruptcy, a common tactic among property owners looking for extra time to save their assets.

Had the building at 54 Thompson Street entered bankruptcy, it may have exposed Empire’s sizable assets — more than 2,000 residential apartments and 1 million square feet of commercial space, according to its website — to creditors of a potentially prodigal son.

In 2021, Richard sold a development parcel on Washington Street in the Financial District for $89 million, several years after suing his father to stop its sale for a reported $148 million.

Read more