In a lawsuit filed by a real estate developer, St. Francis College is accused of being Judas.

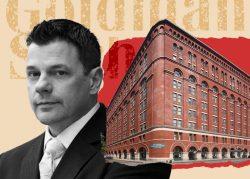

Alexico Group signed a contract in April 2022 to buy the school’s old campus at 180 Remsen Street in Brooklyn Heights for $180 million. But Alexico alleges that St. Francis proverbially stabbed it in the back by instead selling the property to Rockrose Development for $160 million.

Alexico had previously negotiated with Rockrose, run by CEO Henry Elghanayan and Justin Elghanayan, as a potential equity partner on the redevelopment, and as part of those negotiations, Rockrose allegedly signed a nondisclosure agreement that prevented Rockrose from directly negotiating with St. Francis. The college, in its sale agreement with Alexico, also surrendered the right to take competing bids.

Alexico eventually rejected Rockrose as a potential partner because the latter wanted to split the property in two, developing one half as luxury condos and the other half as luxury rentals. Alexico wanted the entire development to be condos, and it decided to proceed without Rockrose.

But the timeline of the sale to Alexico was complicated by the discovery of an 8-foot setback restriction on half of the campus. The restriction, which dates back to the 1850s, curtailed the property’s value.

As a result, Alexico entered into discussions with Fidelity to provide title insurance for the entire property. The day before the scheduled March 30 closing, Fidelity concluded it would not insure the entire property. The closing was canceled.

On March 31, St. Francis informed Alexico it was terminating their agreement and on the same day announced a new, all-cash deal with Rockrose. The timing of the announcement, Alexico argues, strongly implies that St. Francis and Rockrose had been negotiating long before the closing date, which would be a breach of contract.

For its part, St. Francis alleges that Alexico breached contract by not completing the deal before the mutually agreed upon closing date.

“It is unfortunate that [Alexico], who failed to close and unequivocally defaulted in its contractual obligation to acquire the college’s former campus, has chosen to pursue this matter in the courts,” St. Francis said in a statement. “Nevertheless, we remain confident in our position and legal standing, and we will address the matter in the appropriate forum at the appropriate time.”

Alexico is seeking one of two remedies — a sale of the property to it for $160 million or $10 million for the security deposit in addition to damages including costs and lost profit.

Neither Alexico nor Rockrose responded to a request for comment. PincusCo first reported the lawsuit.

This story has been updated to clarify the remedies Alexico is seeking.

Read more